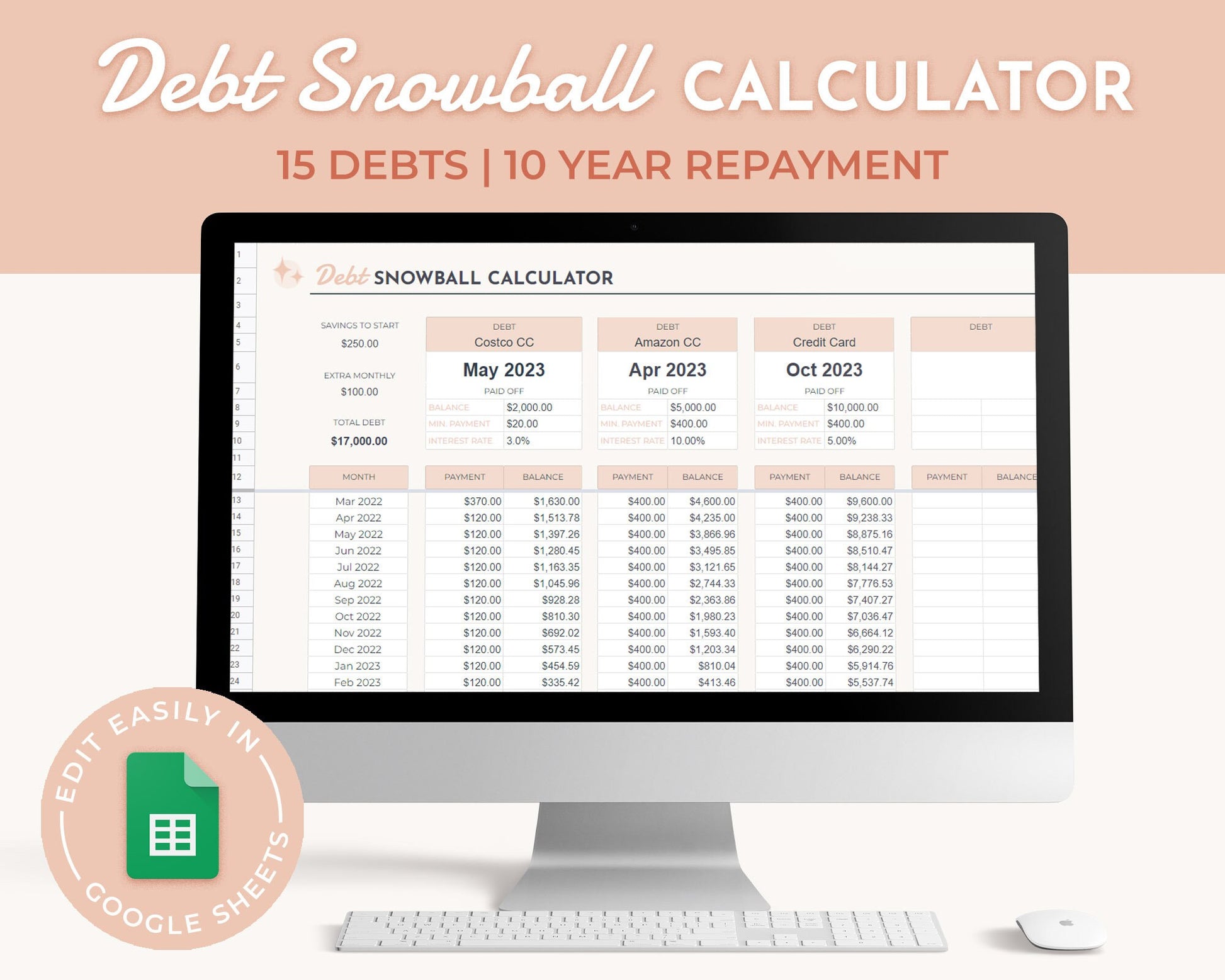

Debt Snowball Calculator

Debt Snowball Calculator

Couldn't load pickup availability

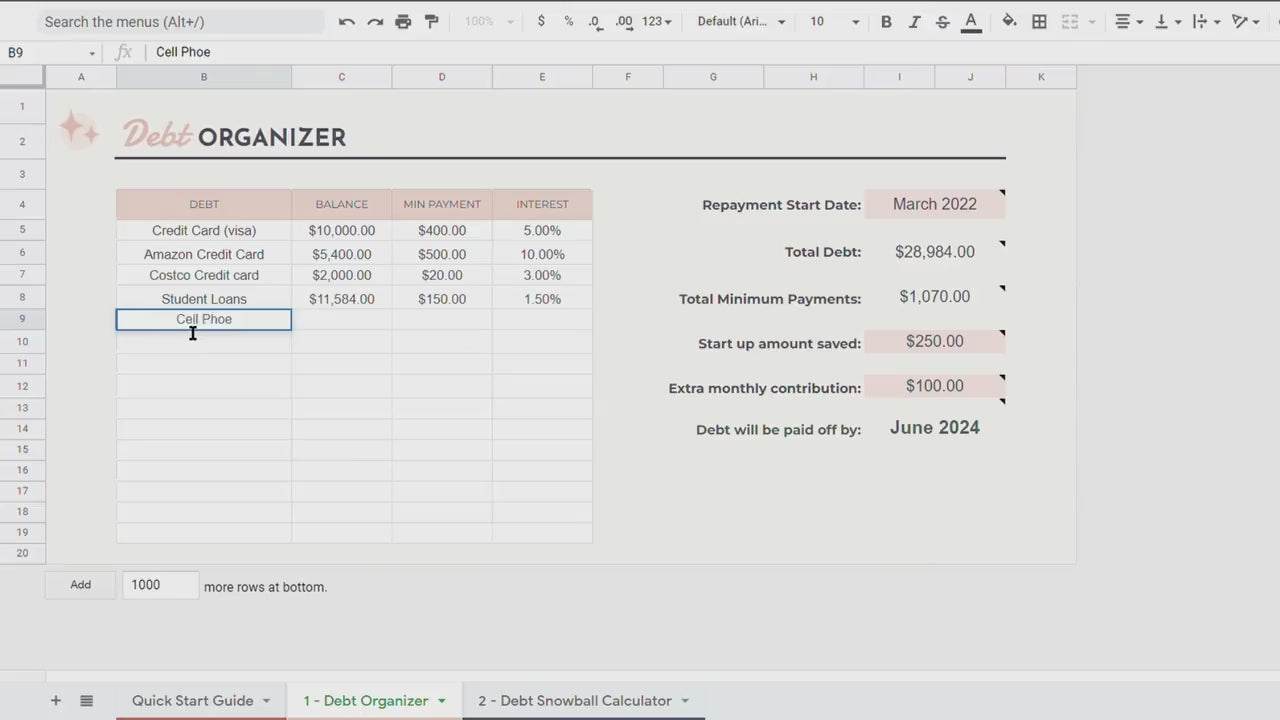

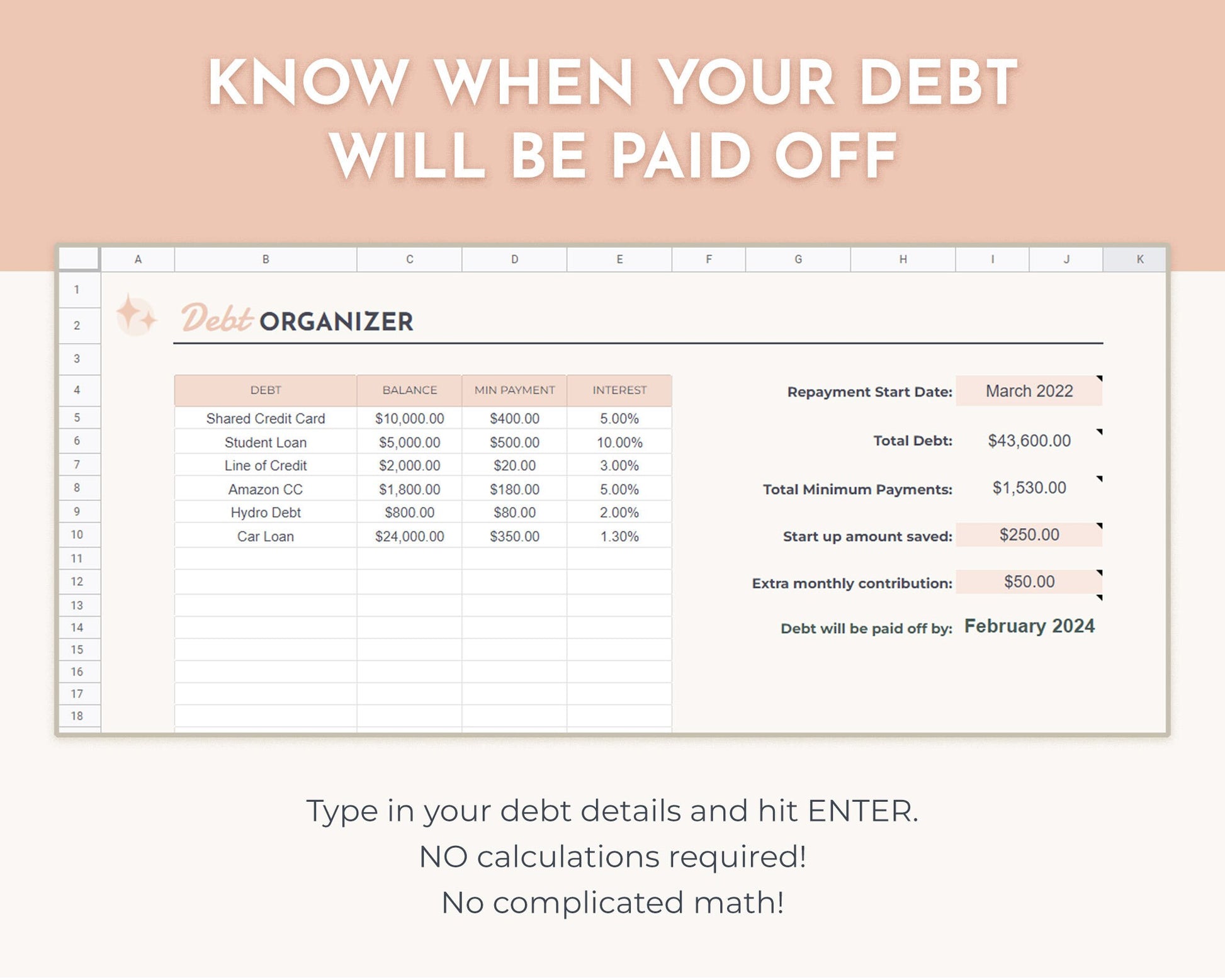

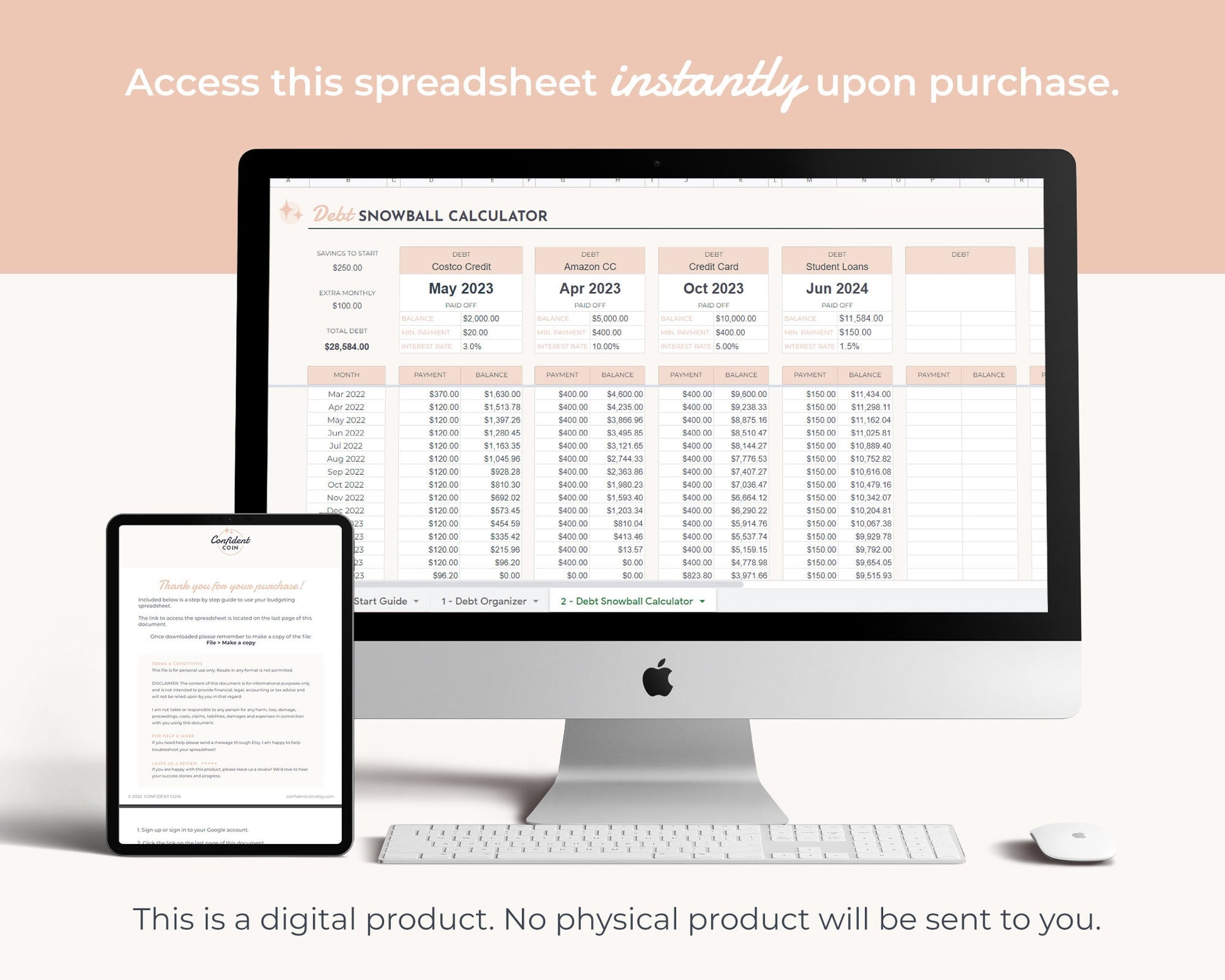

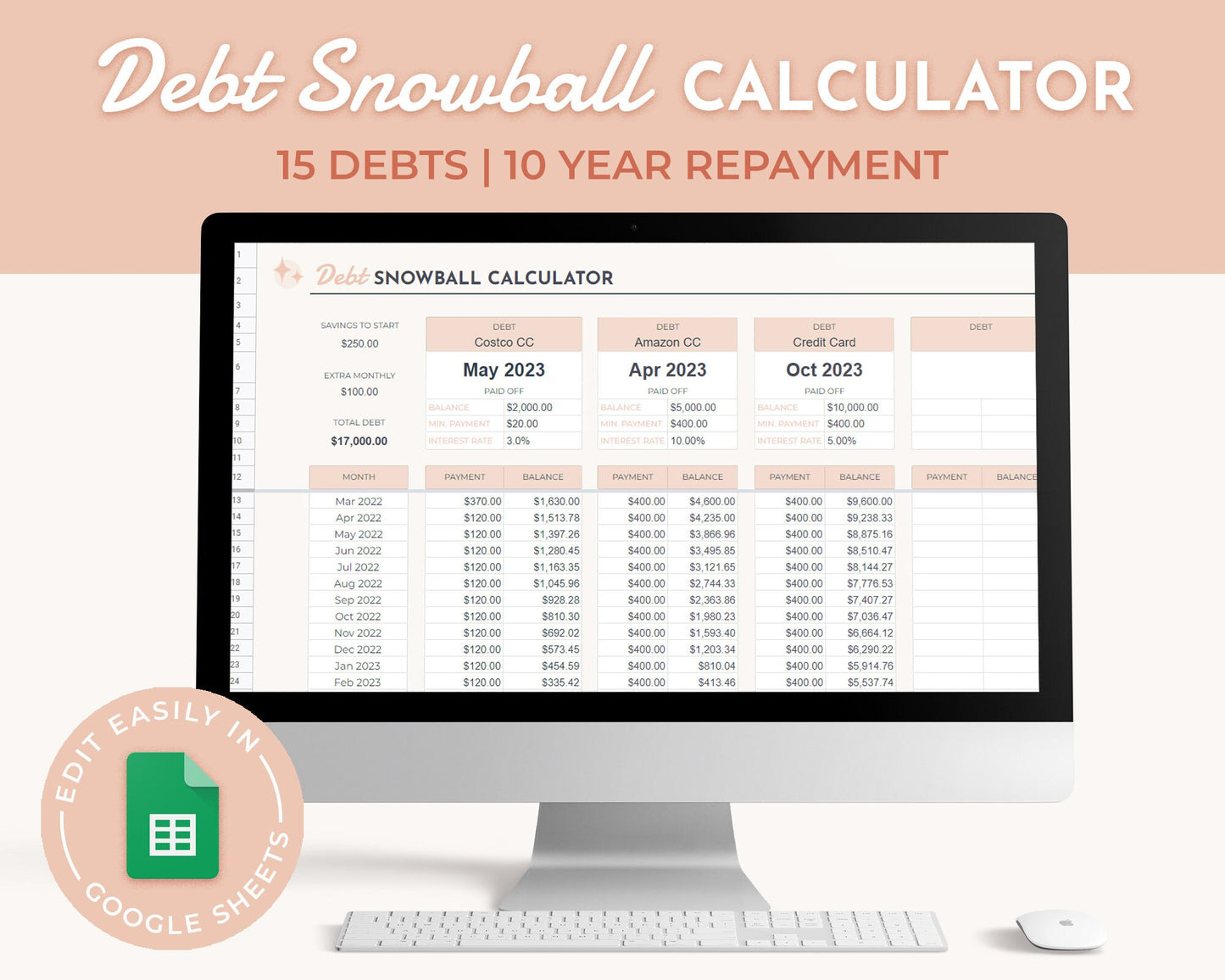

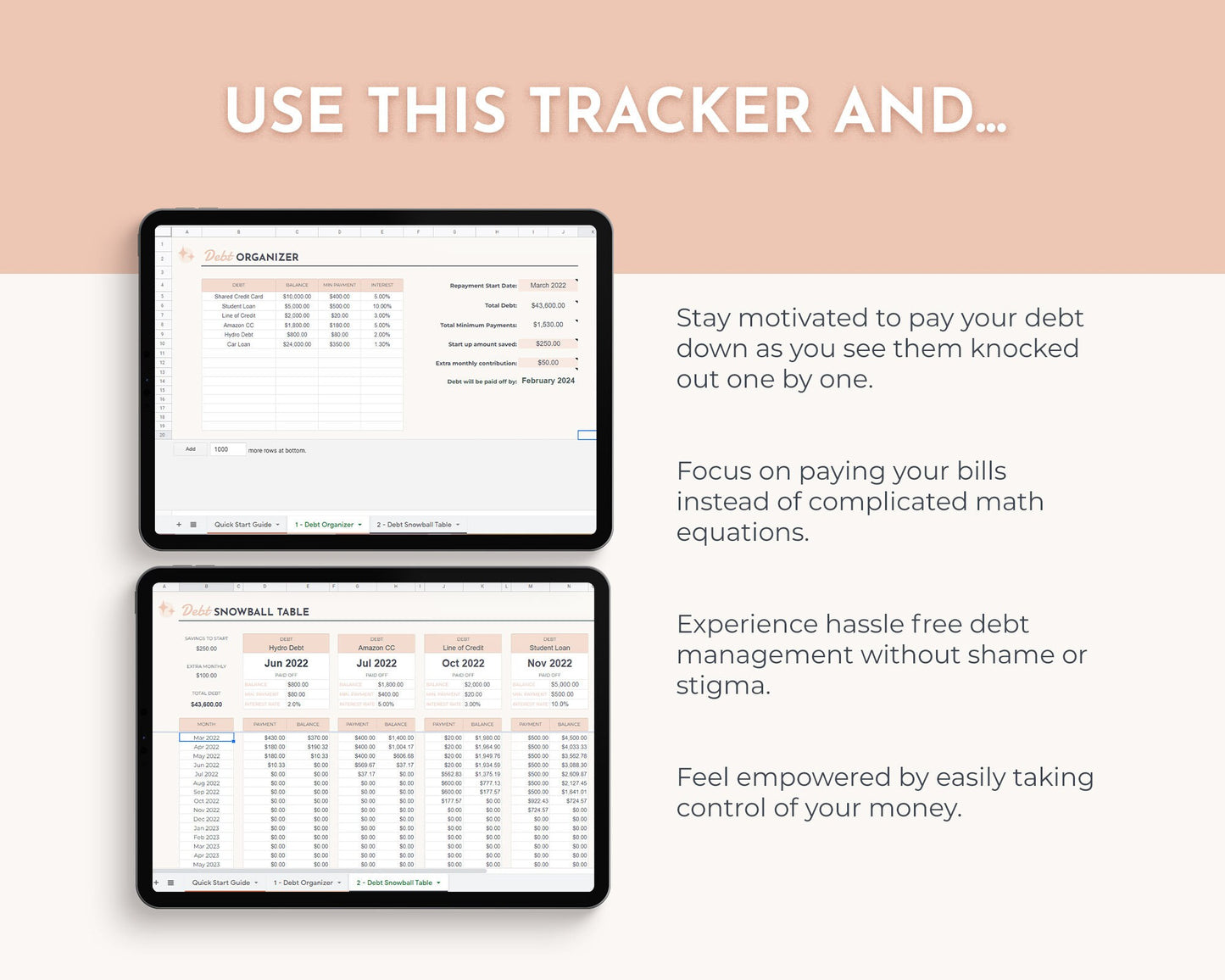

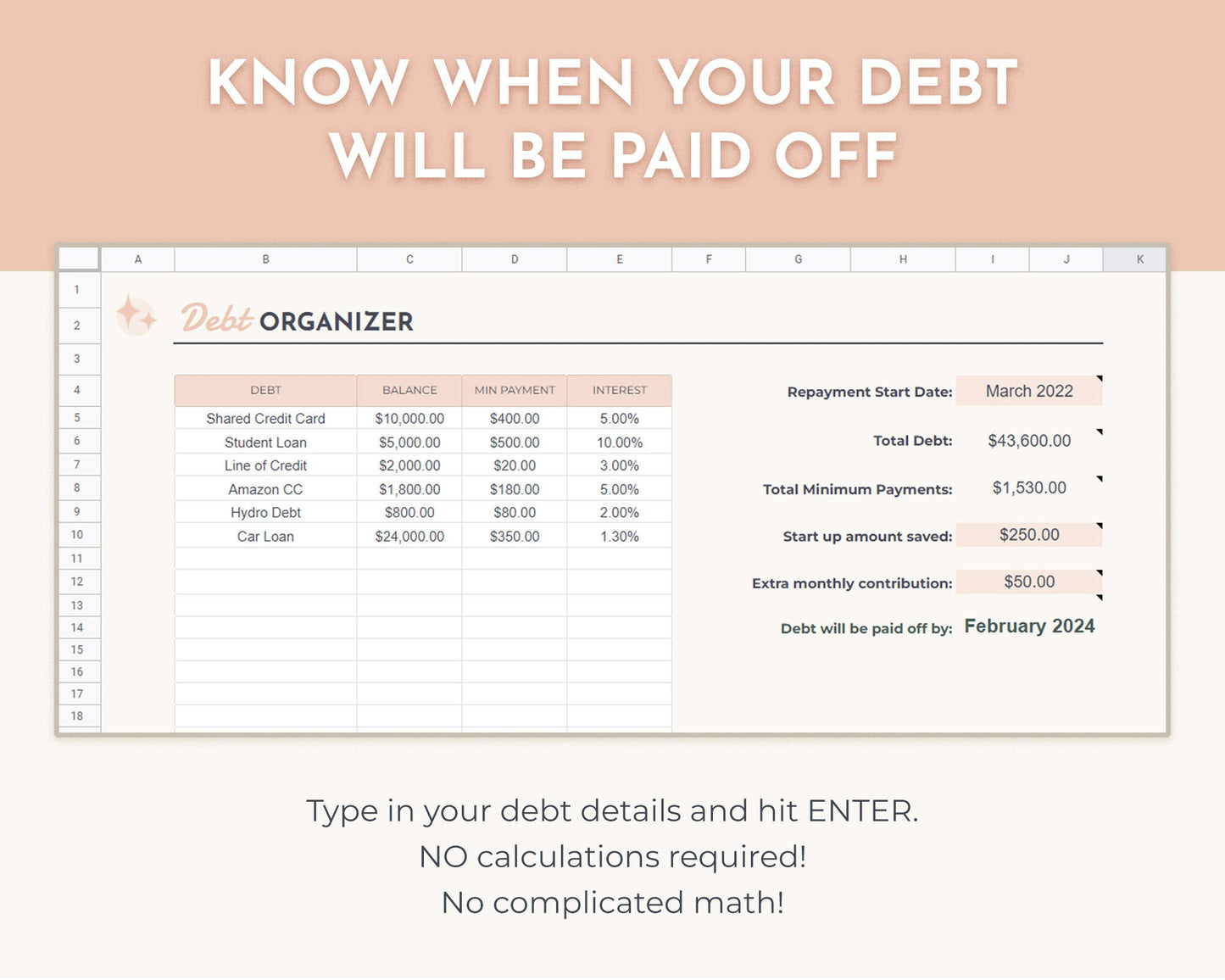

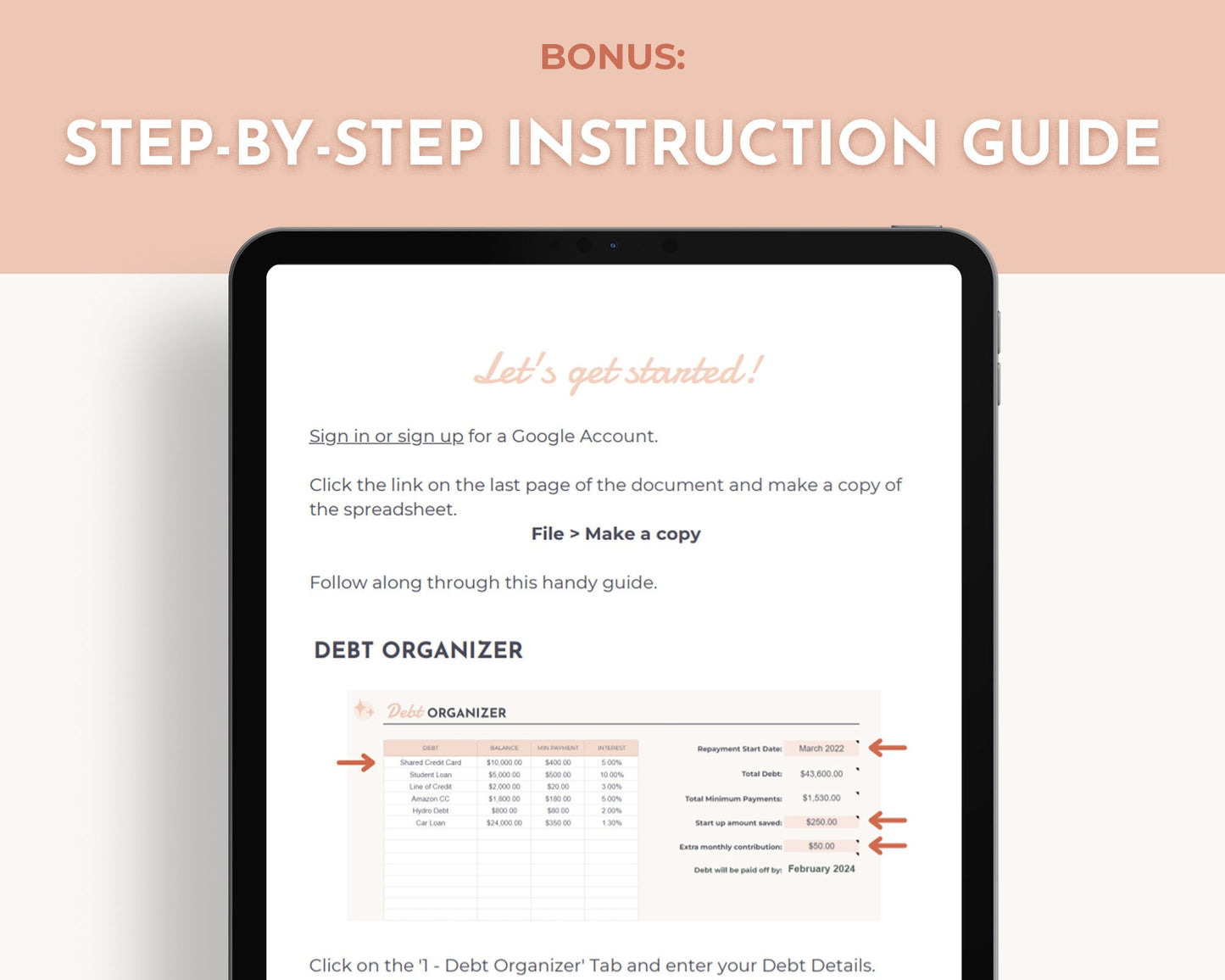

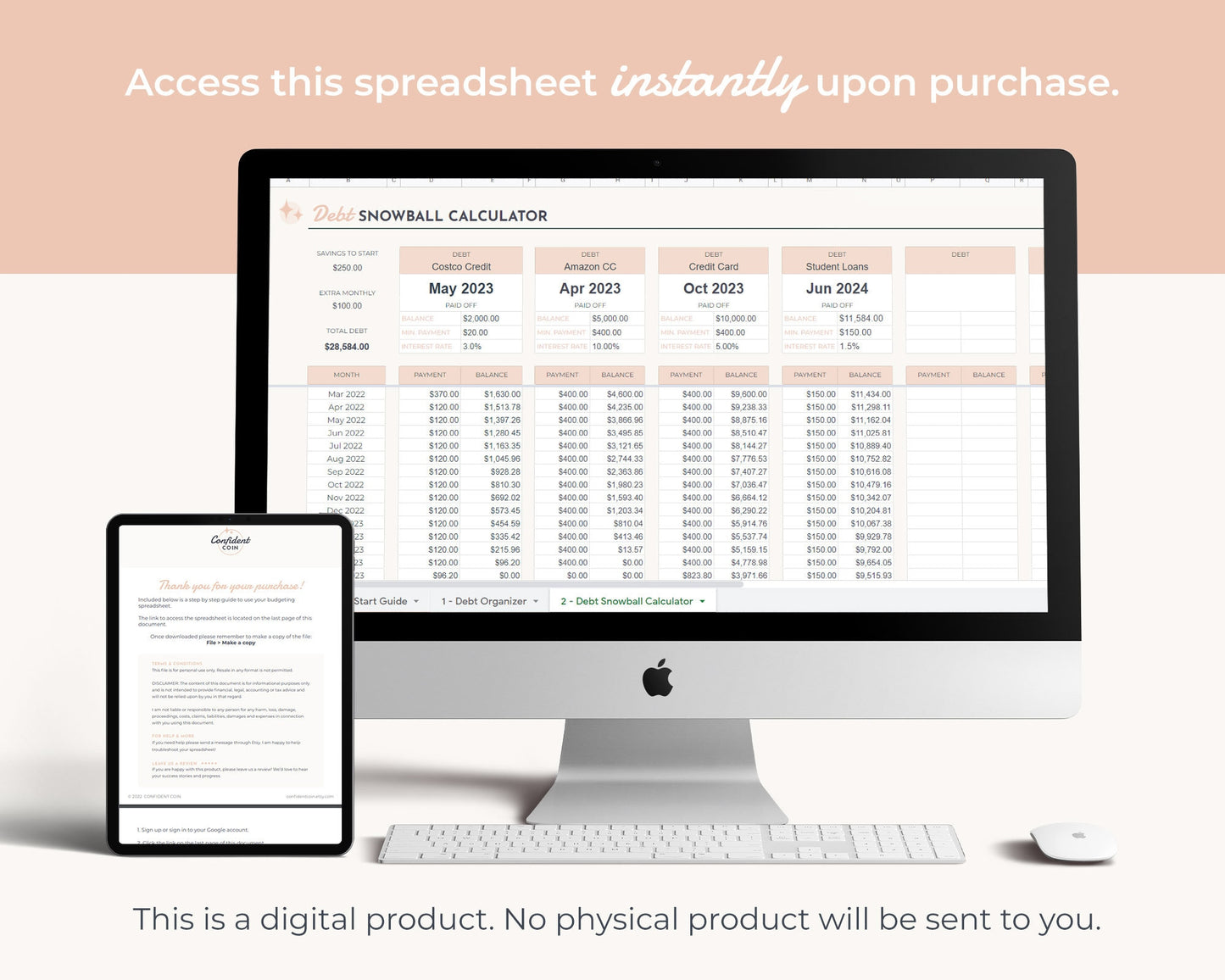

Simply enter in your Debt Details (how much you owe, minimum payments and interest) and have a path laid out for you.

FEATURES:

- 2 Easy to use tabs that keep your debts organized

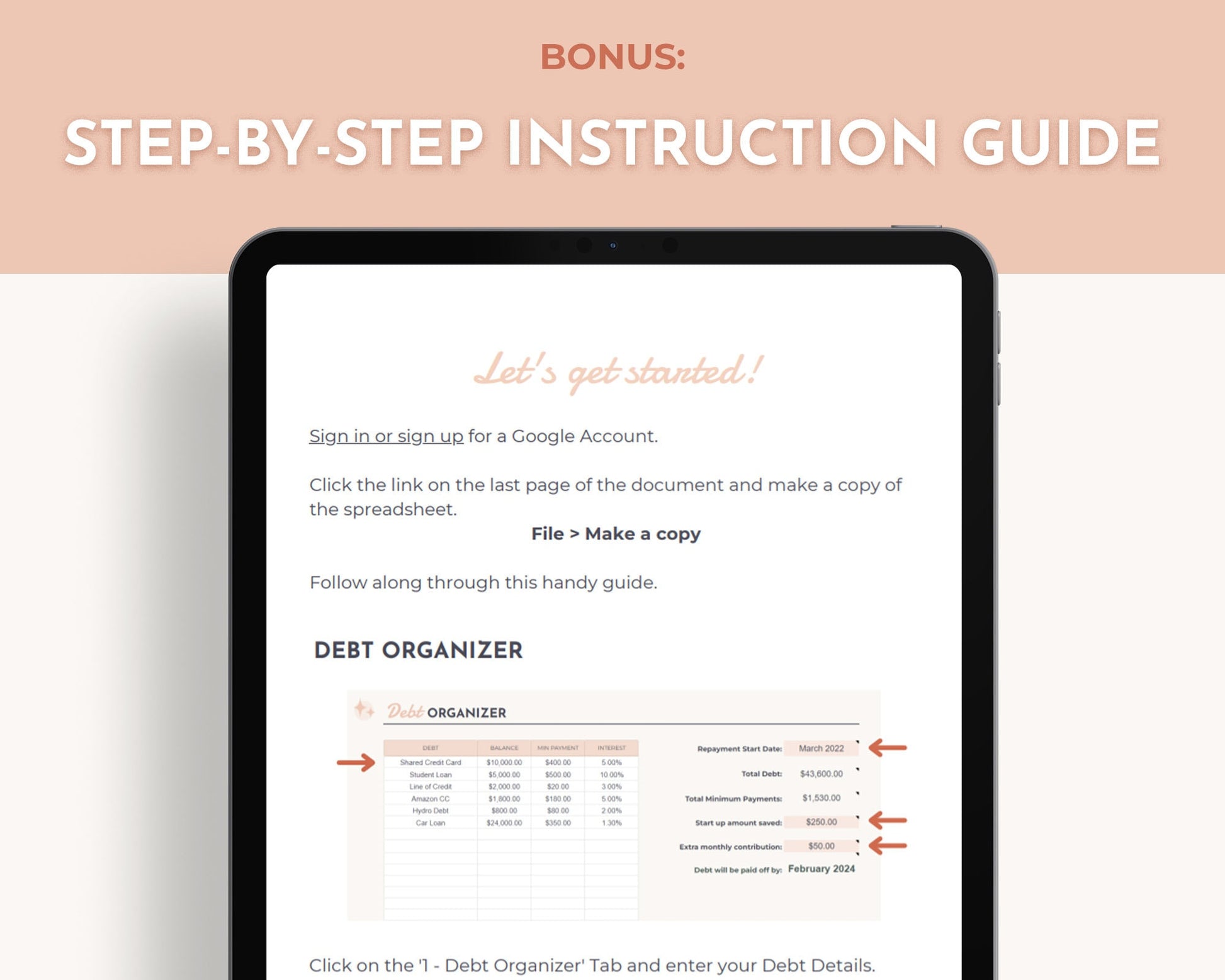

- A BONUS! Step by Step Instruction Guide with photos to walk you through the spreadsheet

- Stay motivated to pay down your debts when you can see how fast it can be done

- No complicated math formulas to figure out

- Includes 15 debts and a 10 year repayment window

- All you need is a FREE Google Account to use the spreadsheets

- You can access this spreadsheet from any device, anywhere anytime!

- Once you purchase the listing, you will download a PDF file. Included in the PDF is a link to access the Google Spreadsheet

- This spreadsheet is used with a FREE google account

- If you need any assistance, please contact us :)

- There are no refunds as this is a digital product. Please send an Etsy message if you need assistance or run into any issues.

- This google sheet is for personal use only. Reselling or sharing is not permitted

Returns

Returns

I don't accept returns, exchanges, or cancellations due to the nature of digital products. That being said, we want help you on your budgeting journey!

Please contact us if you have any problems with your order.

Software Requirement

Software Requirement

Spreadsheets are used with Google Sheets (a free Google Account is required)

OR Excel (excel 365/online).

The files must be used in their matching software; you cannot move the files back and forth between them.

Commercial Usage

Commercial Usage

This spreadsheet is for personal use only. Reselling or sharing is not permitted.

Please contact us for a commercial use license

Share

-

How do I get my spreadsheet?

Once you've completed your purchase you can access a link to your PDF via your email.

The PDF you receive includes thorough instructions and a link to download your file. -

What spreadsheet is best for me?

It depends on how you want to budget and your lifestyle!

If you prefer to budget each paycheck out, try a budget by paycheck or a bi-weekly paycheck budget. If you prefer adding all your income together and budgeting it out, go with Monthly.