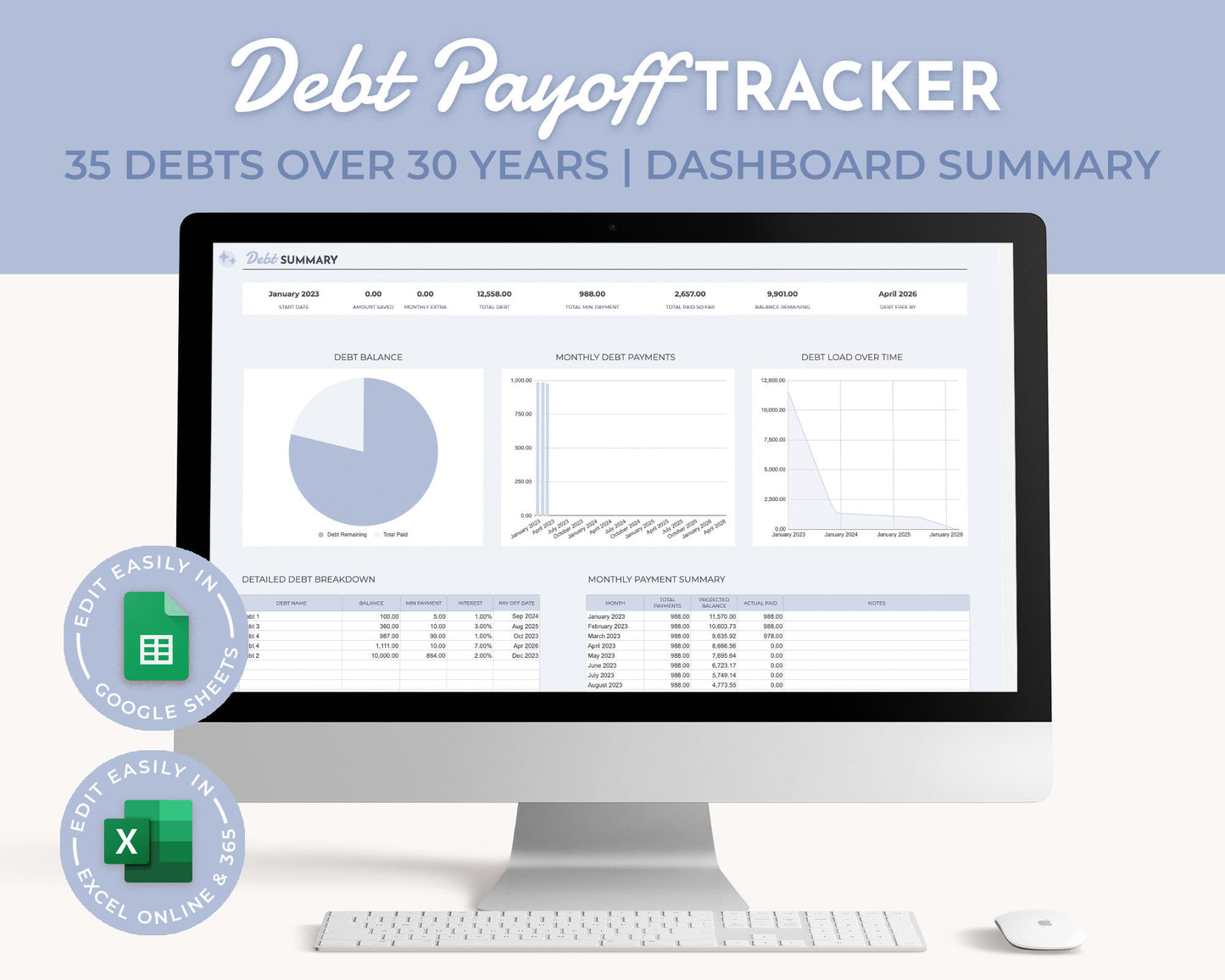

Debt Payoff Tracker Spreadsheet

Debt Payoff Tracker Spreadsheet

Couldn't load pickup availability

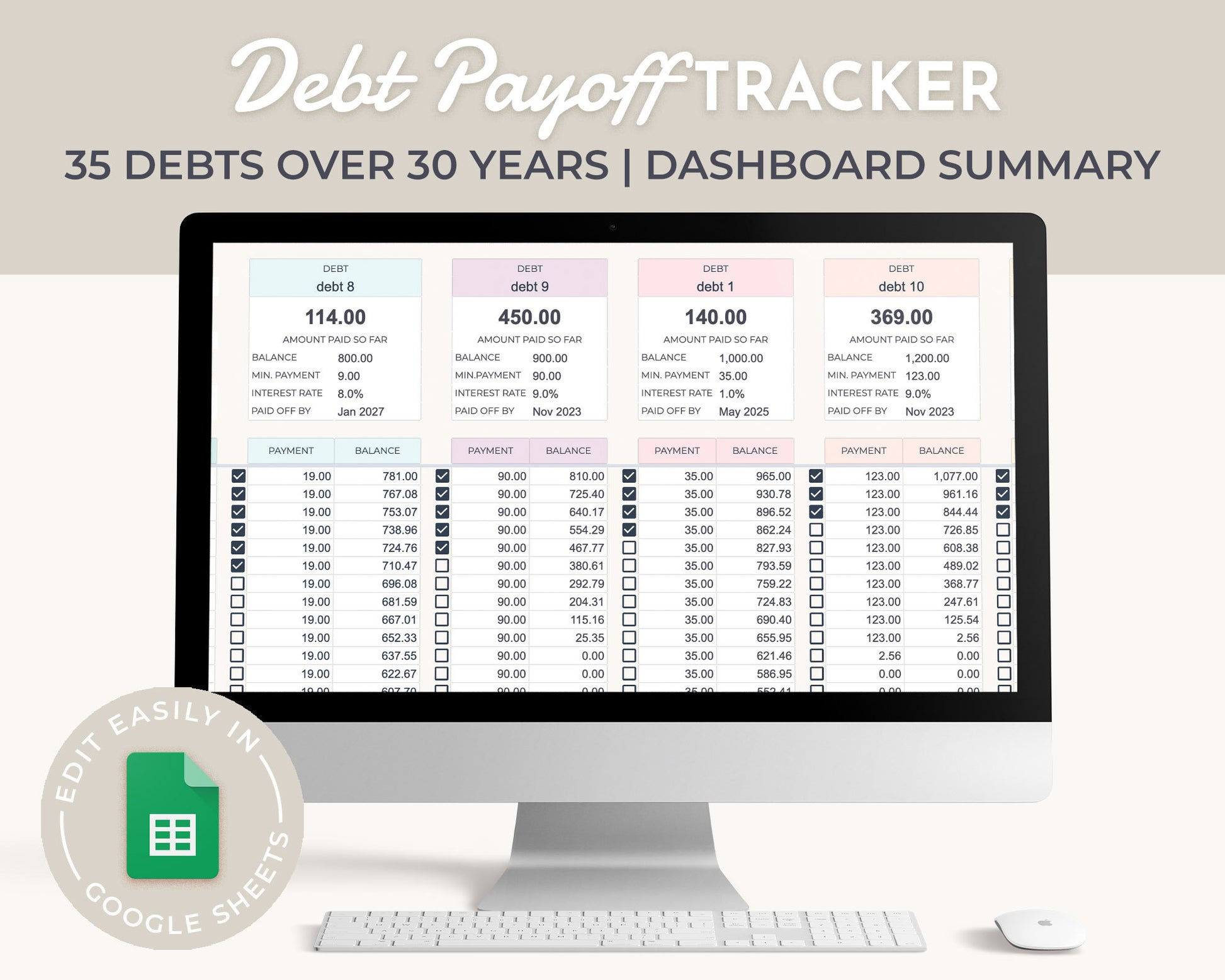

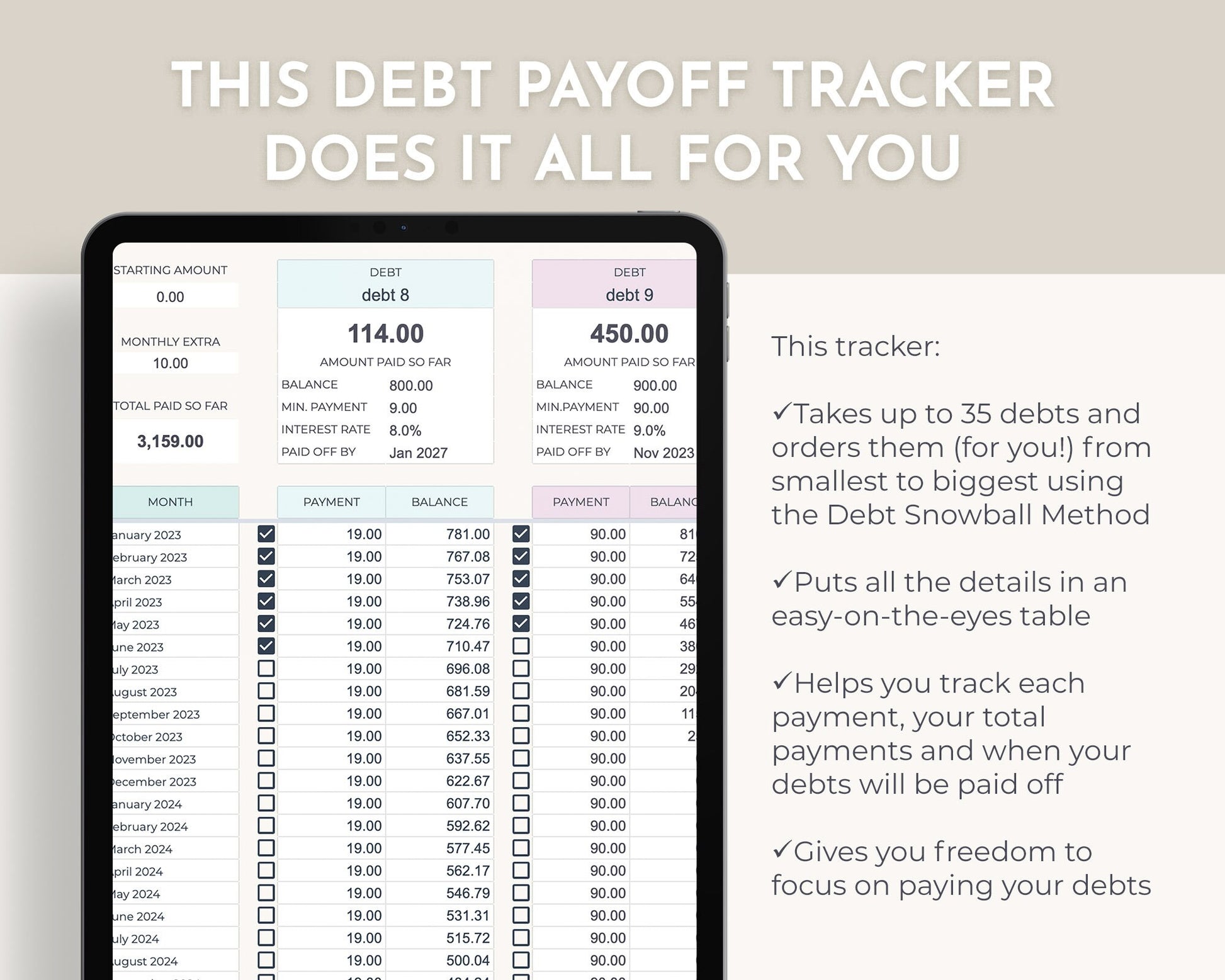

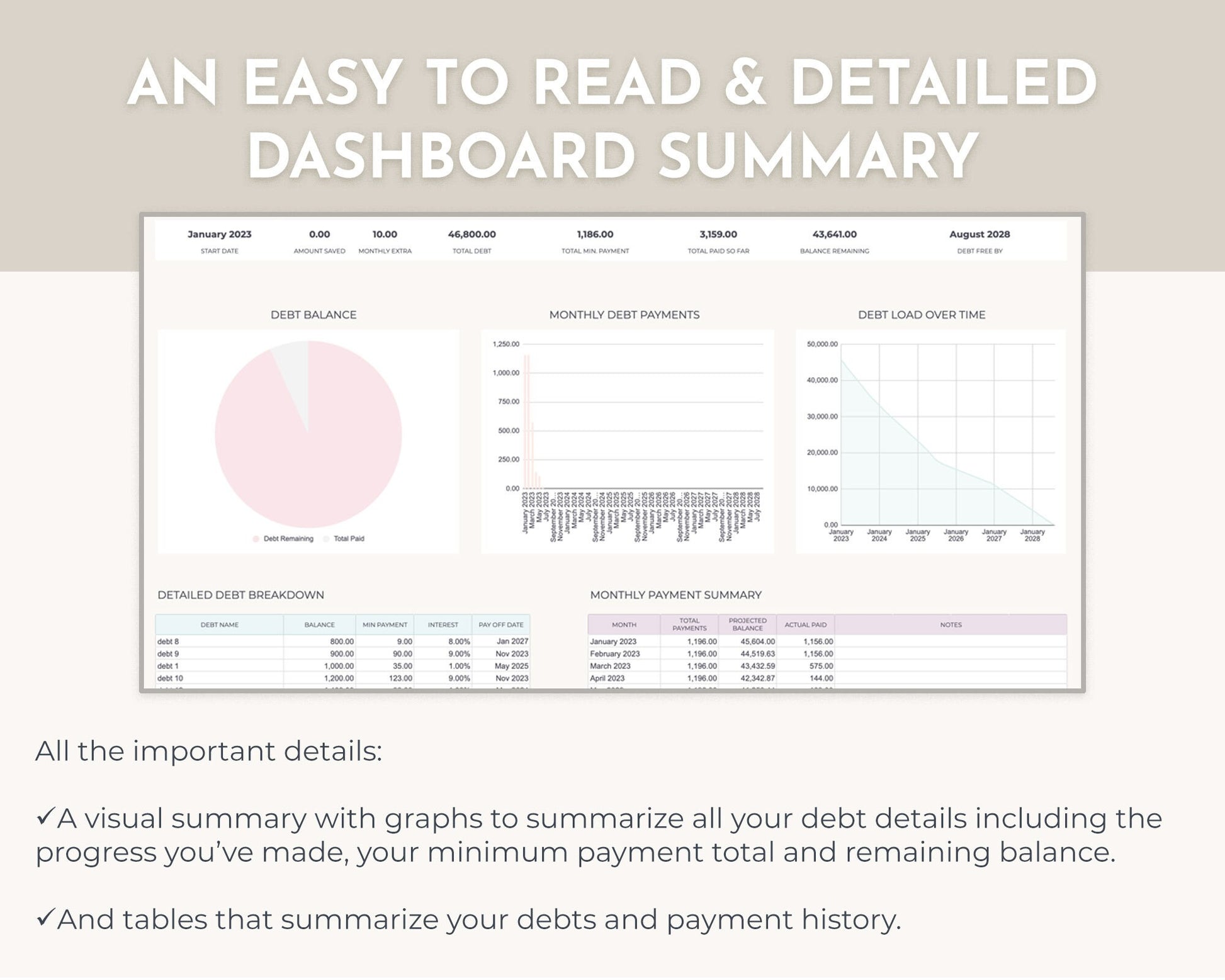

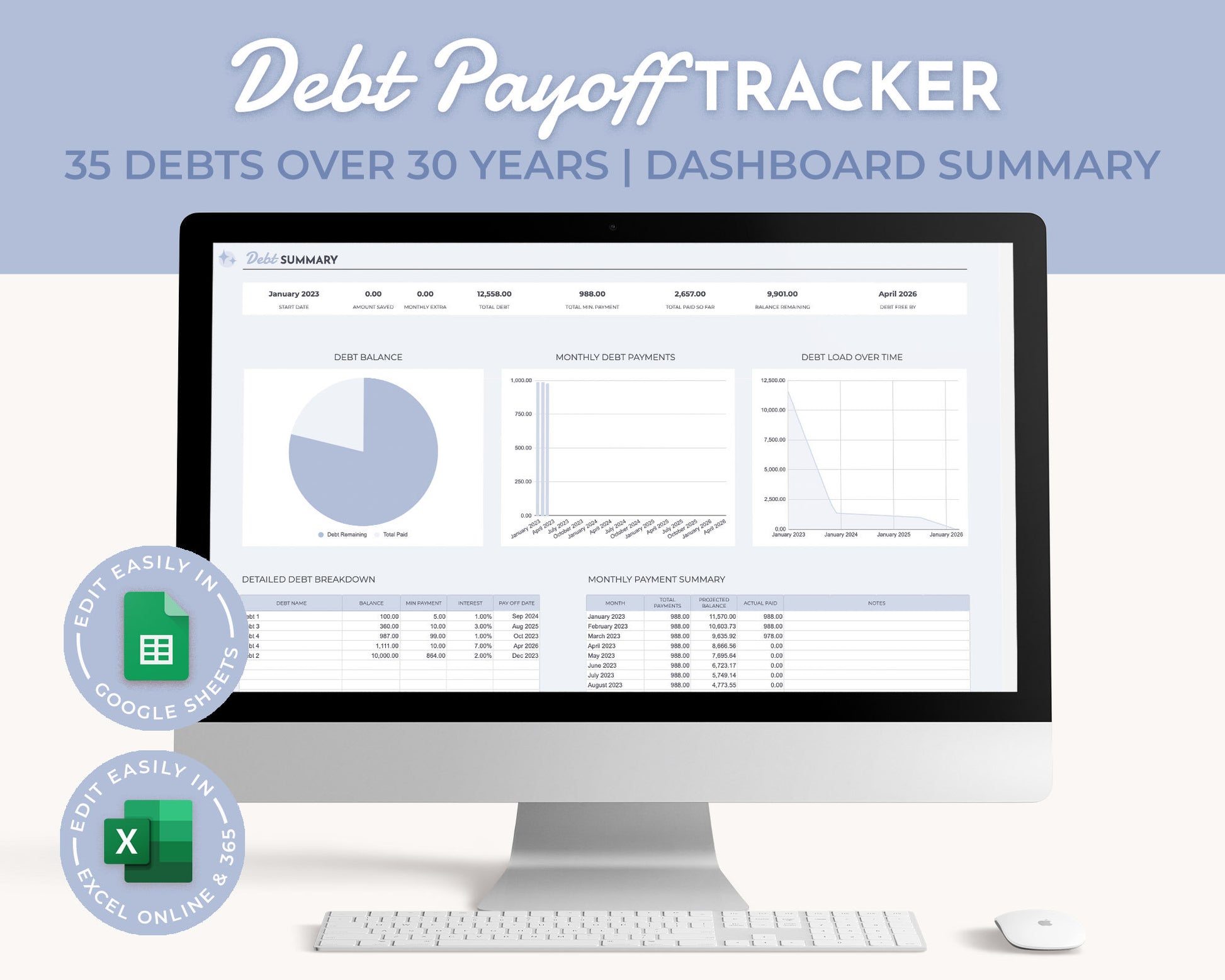

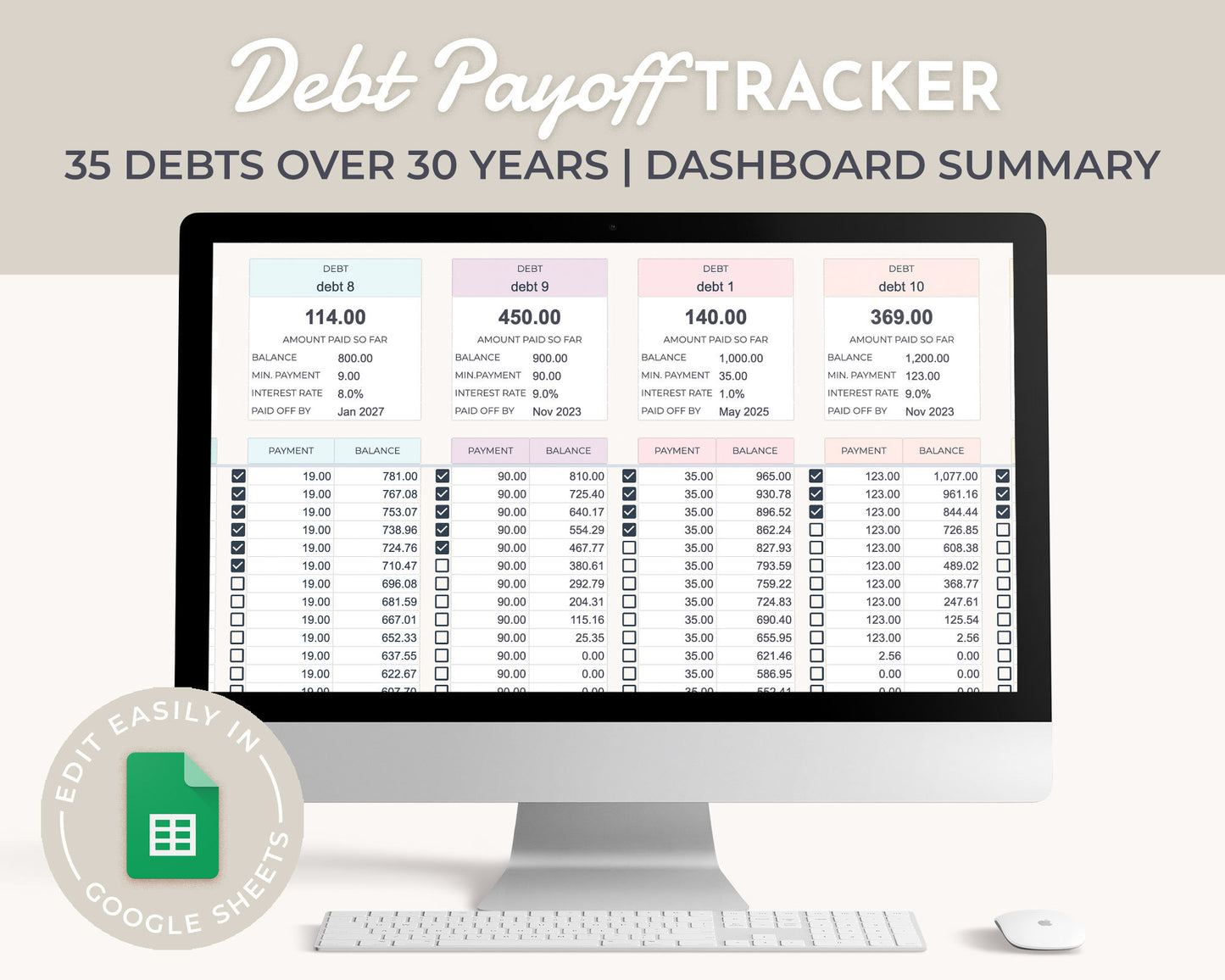

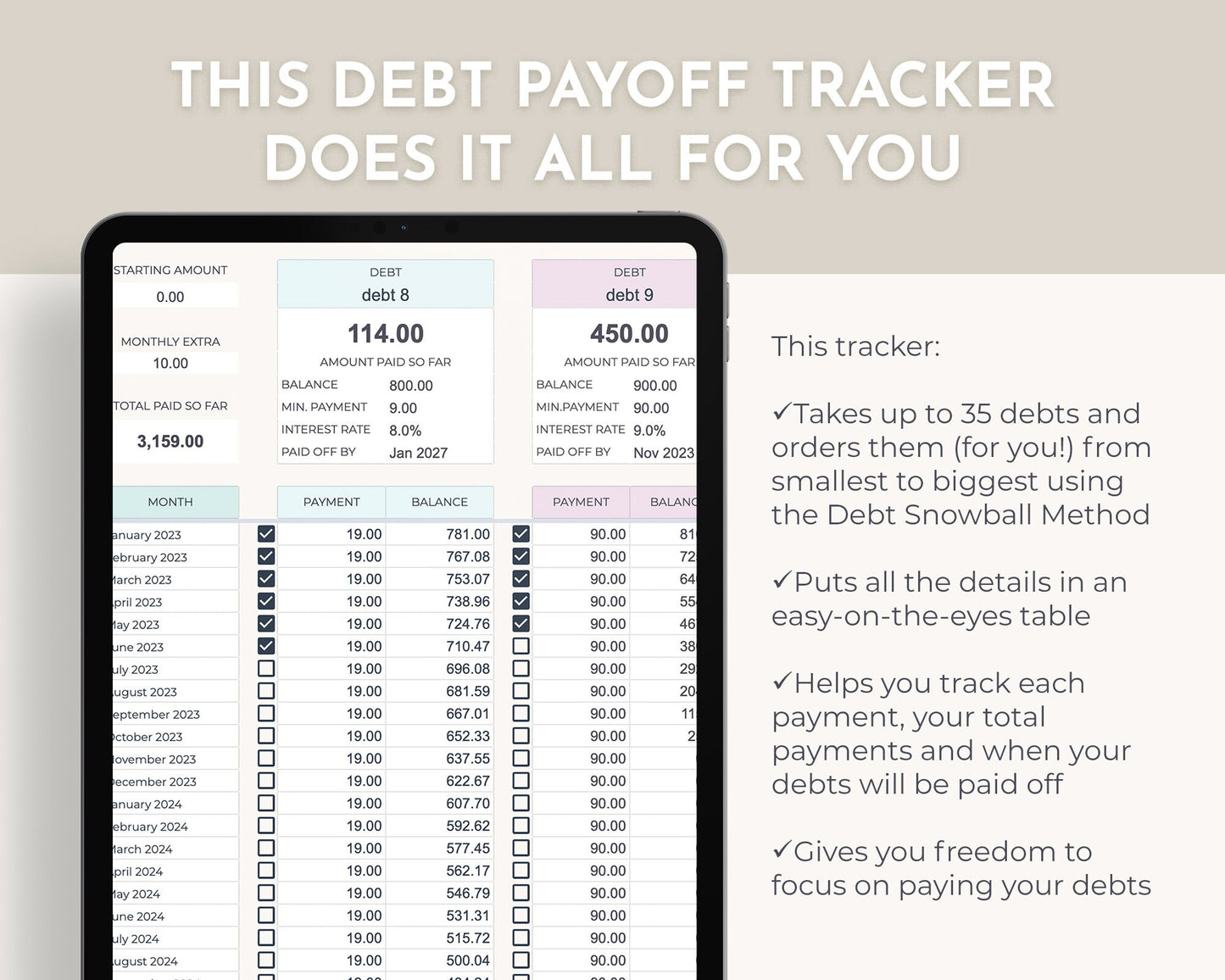

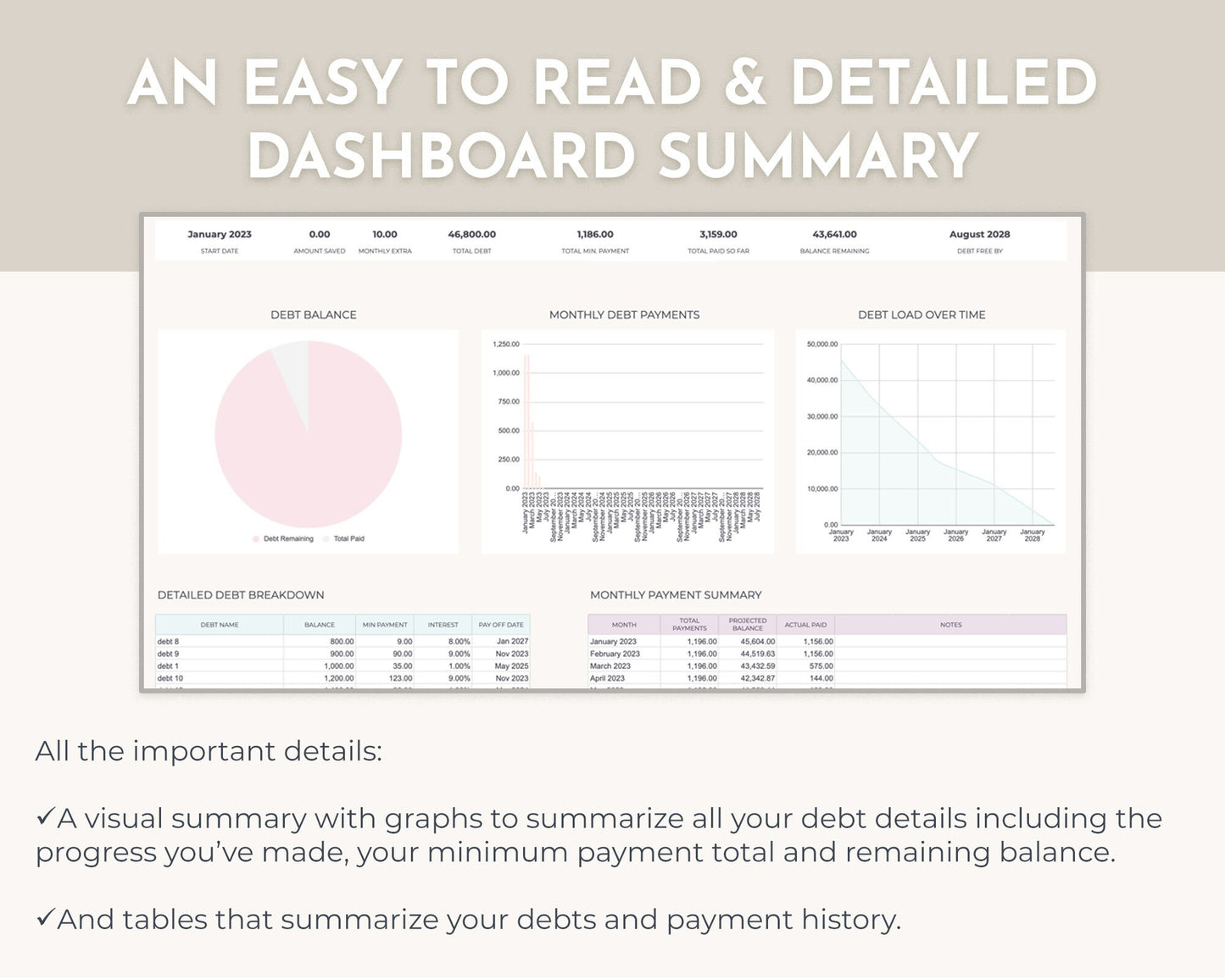

This Debt Payoff Tracker works with Excel and Google Sheets to help you get in control of your debts with the Debt Snowball Method.

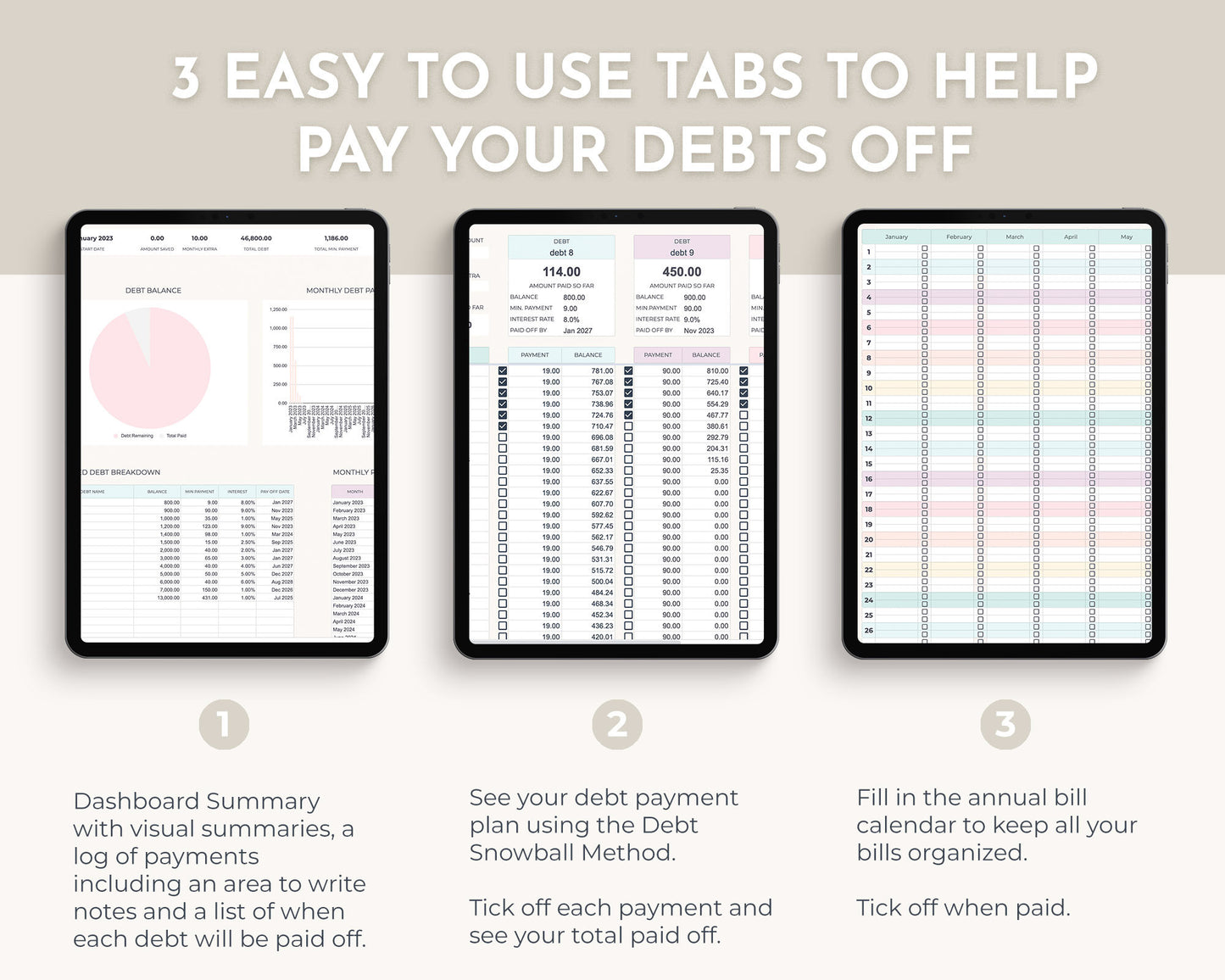

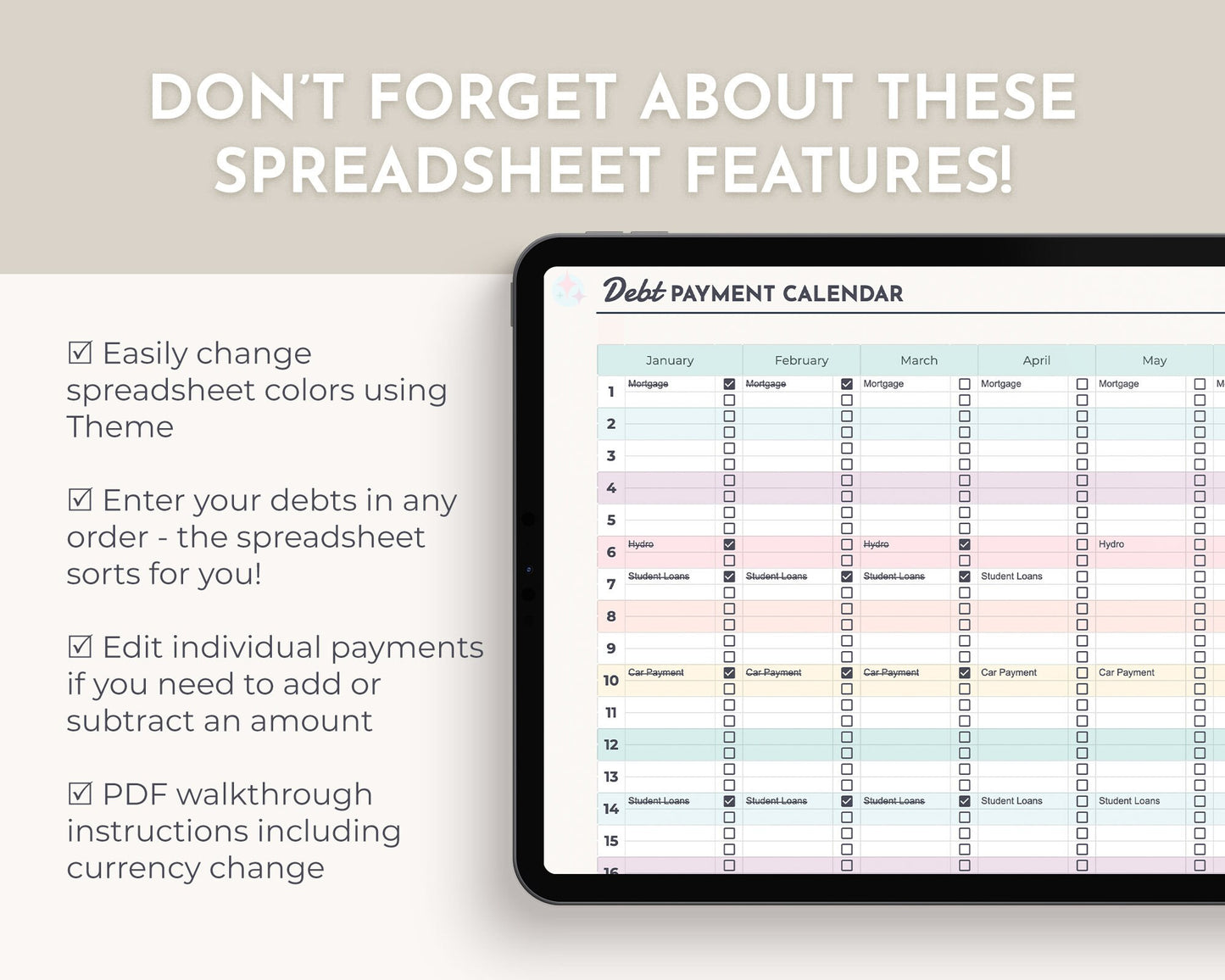

It covers up to 35 debts over 30 years, with a payment tracker, dashboard summary and Annual Debt Payment Calendar.

Simply enter in your Debt Details (how much you owe, minimum payments and interest) and have a debt payment path laid out for you.

See a full video walkthrough

FEATURES:

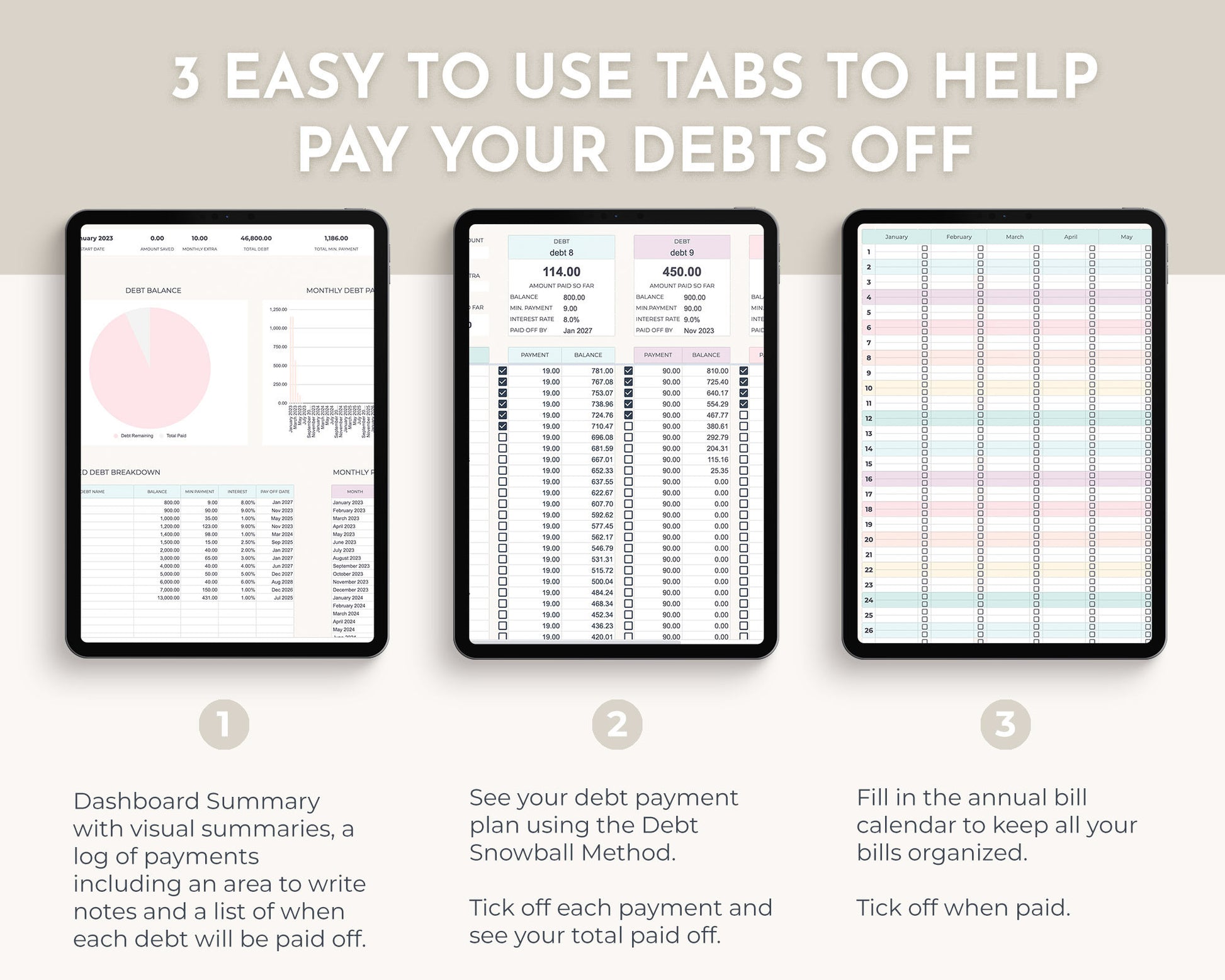

- 4 easy-on-the-eyes tabs:

- Tab 1: Set Up and Instructions

- Tab 2: Debt Dashboard Summary

- Tab 3: Debt Payment Table

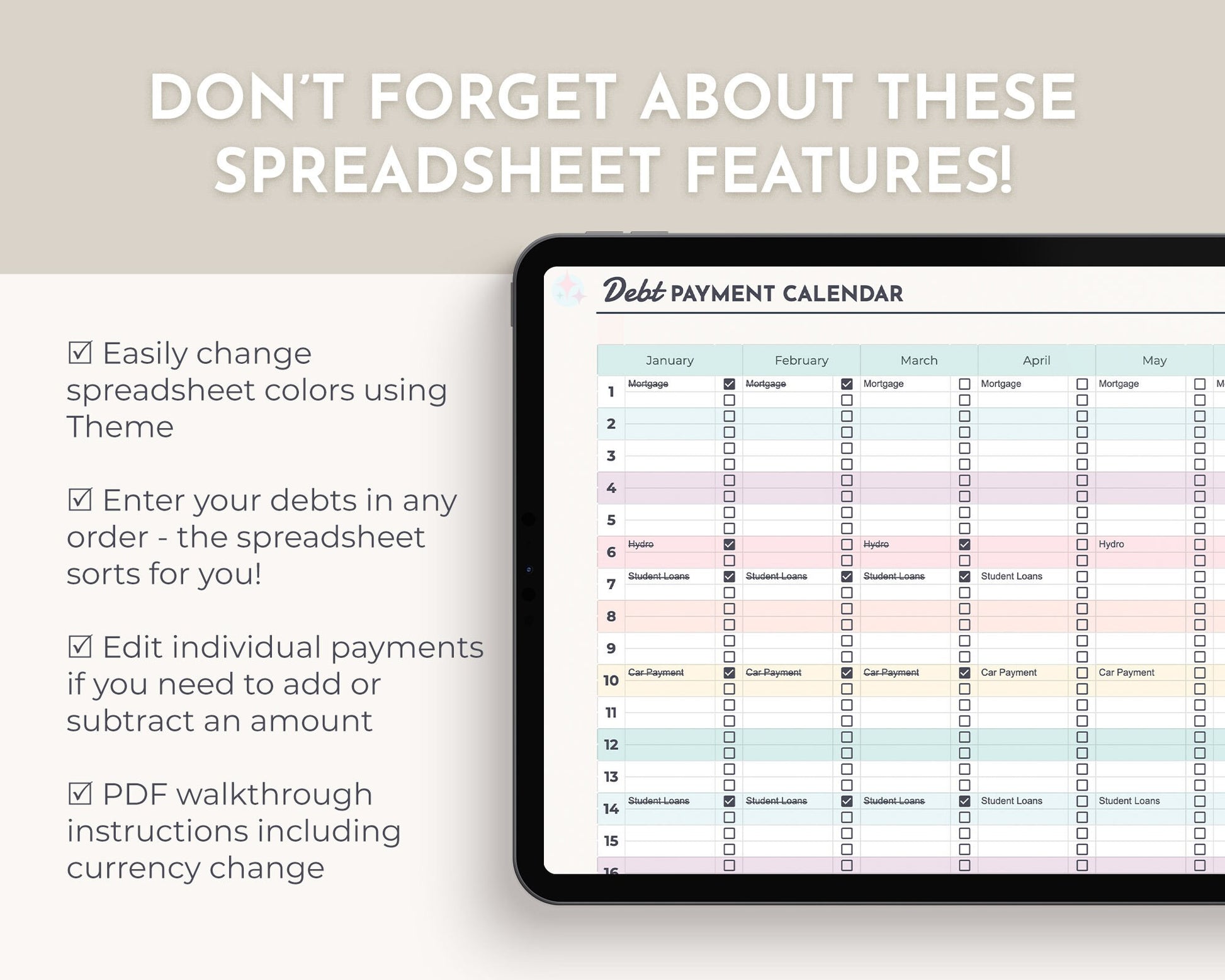

- Tab 4: Debt Payment Calendar

- Once you purchase the listing, you will download an instructional PDF file and/or an Excel File. Included in the PDF is a link to access the Google Spreadsheet.

- This spreadsheet is used with a FREE google account.

- If you need any assistance, please contact us directly.

- There are no refunds as this is a digital product. Please send an Etsy message if you need assistance or run into any issues.

- This google sheet is for personal use only. Reselling or sharing is not permitted

Returns

Returns

I don't accept returns, exchanges, or cancellations due to the nature of digital products. That being said, we want help you on your budgeting journey!

Please contact us if you have any problems with your order.

Software Requirement

Software Requirement

Spreadsheets are used with Google Sheets (a free Google Account is required)

OR Excel (excel 365/online).

The files must be used in their matching software; you cannot move the files back and forth between them.

Commercial Usage

Commercial Usage

This spreadsheet is for personal use only. Reselling or sharing is not permitted.

Please contact us for a commercial use license

Share

-

How do I get my spreadsheet?

Once you've completed your purchase you can access a link to your PDF via your email.

The PDF you receive includes thorough instructions and a link to download your file. -

What spreadsheet is best for me?

It depends on how you want to budget and your lifestyle!

If you prefer to budget each paycheck out, try a budget by paycheck or a bi-weekly paycheck budget. If you prefer adding all your income together and budgeting it out, go with Monthly.