Mapping out a budget is an essential step to achieving financial success.

Whether you want to save money, pay off debt, or build up your emergency fund - having a budget will help keep your finances on track. But what are the essential components of any budget plan?

This is what I am here for, let’s explore 17 of the most important elements to include as you craft your own budget plan.

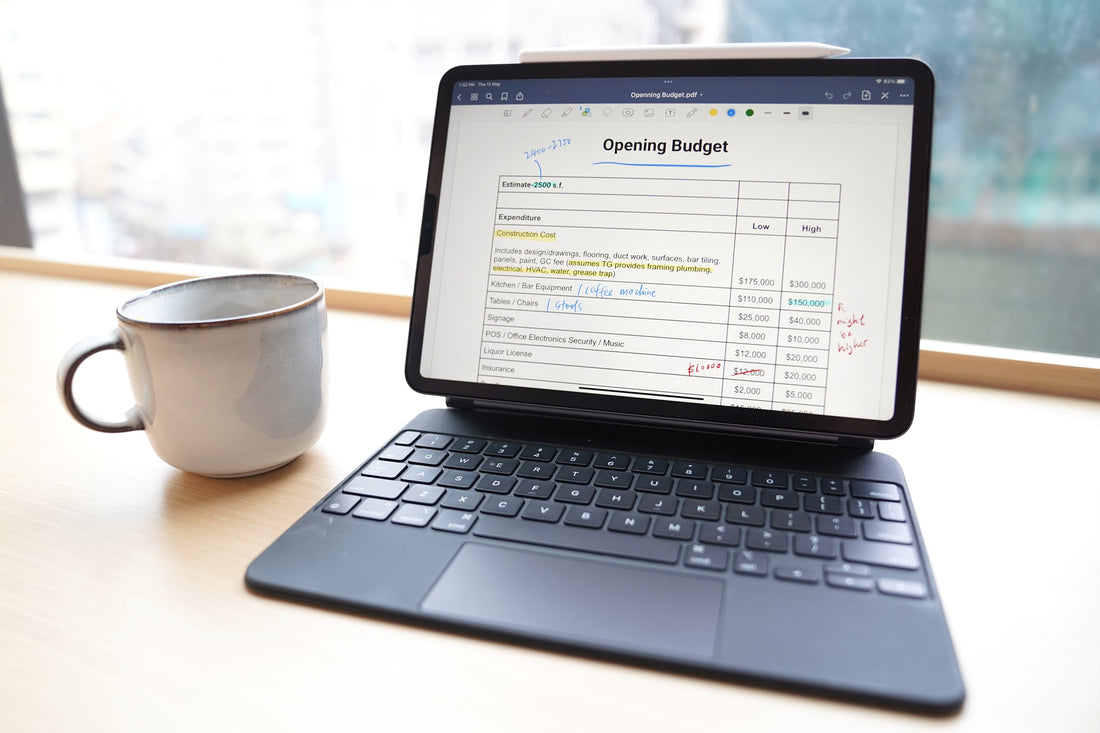

Photo by NORTHFOLK on Unsplash

Rent or Mortgage

One of the key components of any budget is rent or mortgage. Your rent or mortgage payments will typically be your largest monthly expense, so it's important to factor this in when creating your budget.

Here are a few tips for budgeting for rent:

- Know your budget. The first step is to determine how much you can afford to spend on rent each month. This will help you narrow down your search to only affordable options.

- Consider roommates. If you're struggling to afford your rent on your own, consider finding a roommate or two to split the cost with you. This can be a great way to save money while still living in a comfortable space.

- Be flexible with your location. Another way to save on rent is to be flexible with your location. Consider moving to a less expensive area or downsizing to a smaller apartment or house

Food and Groceries

Any good budget plan should have a section for food and groceries. This is one of the most essential components of any budget because it is something that everyone needs in order to live.

There are a few different ways to approach this part of the budget. One way is to track all of your spending on food and groceries for a month and then come up with an average amount to budget for each month. This can be tricky, however, because spending can fluctuate from month to month.

Another way to approach this part of the budget is to figure out how much you need to spend on food and groceries for a week and then multiply that by four. This will give you a good starting point for your monthly budget.

Whichever method you choose, make sure that you leave some wiggle room in your budget for unexpected expenses or months when spending is higher than usual.

Use this simple meal planner with Grocery List and Food Budget Tracker to stay on top of your food finances.

Meal Planner, Grocery List & Budget Tracker

Daily Incidentals & Emergency Funds

Daily incidentals are the small, everyday expenses that can add up quickly and can be easy to overlook. Examples might include things like coffee, snacks, lunch, transportation costs, or other small expenses that you encounter on a daily basis. By including these items in your budget, you can track your spending and make adjustments as needed to stay on track.

An emergency fund is a crucial part of any budget. It is an amount of money that you set aside specifically for unexpected expenses, such as a medical emergency or a major car repair. By including an emergency fund in your budget, you can ensure that you are prepared for unexpected expenses and that you won't have to rely on credit cards or loans to cover them.

Household Maintenance

Household maintenance expenses can include things like routine cleaning, lawn care, pest control, repairs, and replacements of appliances or other items that break down or wear out over time. These expenses can add up quickly, so it's important to budget for them in order to avoid unexpected costs and to ensure that your home remains in good condition.

Here are some tips for including household maintenance in your budget:

- Make a list of all the household maintenance tasks that need to be done on a regular basis, such as cleaning the gutters, replacing air filters, and mowing the lawn.

- Estimate the cost of each task and add it up to get a total monthly or yearly expense.

- Set aside a specific amount of money in your budget each month or year for household maintenance expenses.

- Consider setting up a separate savings account specifically for household maintenance expenses. This can help you save money specifically for these types of expenses and avoid using credit cards or other forms of borrowing to pay for them.

Subscriptions and Memberships

Recurring expenses can add up quickly over time so be sure to add any subscriptions and memberships in your budget. Examples of subscriptions and memberships can include gym memberships, Netflix, Spotify, etc.

If you are in a position where you need to save money, consider cancelling some of the unnecessary subscriptions such as Netflix or Spotify. They’re ‘wants’, not ‘needs’.

Travel Expenses

This is important if you plan to travel regularly, as travel costs can add up quickly. Whether you're planning a vacation or a business trip, here are some tips for including travel expenses in your budget:

- Determine your travel destination, dates, and mode of transportation. Research the cost of airfare, gas, or public transportation to and from your destination.

- Estimate your accommodation costs, such as hotel or Airbnb fees.

- Determine your daily expenses, including meals, entertainment, and transportation costs. Research the cost of food and drinks at your destination, as well as any activities or attractions you plan to visit.

- Set aside additional funds for unexpected expenses or emergencies, such as medical costs or trip cancellations.

- Create a travel budget that includes all of these expenses, and make sure to stick to it while on your trip.

If you plan to travel frequently, consider setting up a separate savings account specifically for travel expenses. This can help you save money specifically for these types of expenses and avoid using credit cards or other forms of borrowing to pay for them.

This also goes into factoring in parking fees if you own a car or frequently drive going to and from work.

Prescriptions, Medicines and Healthcare

This will help you plan for healthcare expenses and ensure that you have enough money to cover these costs.

Pet Care

Creating a budget for pet care can help you manage your expenses and ensure that your furry friend gets the care they need. Here are some steps you can take to create a pet care budget:

- Identify regular expenses: Start by identifying the regular expenses associated with pet care, such as food, treats, toys, and grooming supplies. Determine how much you spend on these items each month.

- Factor in veterinary care: Veterinary care is an important part of pet care and can be a significant expense. Include regular checkups, vaccinations, and preventive treatments in your budget. Consider setting aside some money for unexpected veterinary expenses, such as emergency care or unexpected illnesses.

- Include pet insurance: Consider purchasing pet insurance as part of your pet care budget. This can help cover unexpected veterinary costs and give you peace of mind.

- Look for ways to save: Look for ways to save on pet care expenses, such as buying pet food and supplies in bulk or using coupons and discounts. Consider making your pet's toys and treats at home, which can be a fun and cost-effective way to provide for your pet's needs.

- Set a monthly budget: Based on your research and estimates, set a monthly budget for pet care expenses. Be sure to include all regular and unexpected expenses.

- Track your expenses: Keep track of your pet care expenses to ensure that you stay within your budget. Adjust your budget as necessary to accommodate any changes in your pet's needs.

Bank Account Fees

This is a sneaky one people tend to forget. Paying bank account fees can add up and be a significant expense for some people, and if you pay close attention to this, you can avoid unnecessary fees. Here are some tips for creating a budget for bank account fees:

- Identify your bank account fees: The first step is to identify the bank account fees you are currently paying, such as monthly maintenance fees, overdraft fees, ATM fees, and transaction fees. Look at your bank statement to identify these fees.

- Check for fee waivers: Many banks offer fee waivers if you meet certain criteria, such as maintaining a minimum balance or setting up direct deposit. Check with your bank to see if you qualify for any fee waivers.

- Consider switching banks: If you are paying high fees and don't qualify for any fee waivers, consider switching to a different bank that offers lower or no fees. Do your research and compare the fees and benefits of different banks before making a decision.

- Set a monthly budget: Based on your bank account fees and any fee waivers, set a monthly budget for bank account fees. Make sure to include any unexpected fees that may arise, such as overdraft fees.

- Monitor your account: Monitor your account regularly to ensure that you are staying within your budget and avoiding unnecessary fees. Set up alerts to notify you when your balance falls below a certain amount or when a fee is charged.

Car Registration

If you own a car, registering it is a necessary expense. Set a monthly budget based on your registration fee and any additional fees. If your car registration fee is due annually, divide the total fee by 12 to determine how much you will need to save each month.

This is where sinking funds come in handy make sure you have enough money to cover your car registration when it is due. This is a separate savings account where you can set aside money each month specifically for car registration and other car-related expenses.

Debt Payments

Managing debt is an important part of any budget, as it can have a significant impact on your finances. Check out these 20 simple tips on how to pay off debt fast.

Simple Debt Payoff Tracker Spreadsheet

Entertainment, Birthdays & Holiday Gifts

These are important aspects of our social lives, but they can also be a significant expense.

Tips and tricks on how to budget these expenses:

- Identify your expenses: The first step is to identify your entertainment expenses, including movies, concerts, dining out, and other activities. Additionally, make a list of upcoming birthdays and holidays, and estimate how much you will need to spend on gifts.

- Prioritize your spending: While it's important to enjoy yourself and celebrate special occasions, it's also important to prioritize your spending. Decide which activities and events are most important to you, and focus your spending on those.

- Set a monthly budget: Based on your estimated expenses, set a monthly budget for entertainment and gifts. Make sure to also include any additional expenses such as travel, decorations, and food.

- Look for ways to save: Look for ways to save on entertainment and gift expenses, such as using coupons, taking advantage of discounts and promotions, and making your own gifts. Consider opting for experiences instead of material gifts, which can often be more meaningful and memorable.

- Track your spending: Keep track of your spending to ensure that you stay within your budget. Consider using a budgeting app or spreadsheet to track your expenses and make adjustments as necessary.

Charity

Giving to charity is a noble and fulfilling act, but it's important to budget for it to ensure that you don't overspend or neglect other important expenses. Here are some of my personal tips:

Determine your charitable giving goals: The first step is to determine how much you want to give to charity and which charities you want to support. Consider your personal values and causes that are important to you.

- Prioritize your giving: Decide which charities are most important to you and prioritize your giving accordingly. Consider setting up automatic donations for your top priority charities.

- Set a monthly budget: Based on your charitable giving goals, set a monthly budget for donations. Make sure to include any recurring donations and any anticipated one-time donations.

- Look for ways to maximize your impact: Look for ways to maximize your impact, such as donating to charities that have a high rating from independent evaluators or donating during matching campaigns. Consider volunteering your time or skills to charities as well.

- Track your giving: Keep track of your charitable giving to ensure that you stay within your budget. Consider using a budgeting app or spreadsheet to track your donations and make adjustments as necessary.

Child care

Child care can be a significant expense for families, especially for those with young children who require full-time care. Ensure you’ve done your research on child care options in your area, including daycare centers, in-home daycare providers, and nannies. Look at the cost and quality of care provided by each option.

Personal care

This can include a wide variety of items, such as haircuts, skincare products, etc. Prioritizing your spending, researching costs, setting a monthly budget, and looking for ways to save can all help you stay within your budget and still take care of your personal needs.

Utilities

These are are essential household expenses, including electricity, gas, water, and internet.

With inflation going so hight, here are tips for creating a budget for utilities:

- Review your past bills: Look at your past utility bills to see how much you typically spend each month. This will give you a good starting point for creating your budget.

- Estimate your usage: Estimate your expected usage for each utility based on your past bills, your living situation, and your personal habits. For example, if you have a larger home, you can expect to use more electricity and water.

- Set a monthly budget: Based on your estimated usage and the cost of each utility, set a monthly budget for each expense. Make sure to include any recurring expenses, such as internet or cable subscriptions.

- Look for ways to save: Look for ways to save on your utility bills, such as turning off lights when you leave a room, taking shorter showers, or using energy-efficient appliances. You can also consider switching to a different provider or plan if it will save you money.

- Monitor your usage: Monitor your actual usage each month and compare it to your estimated usage. Adjust your budget as necessary to reflect any changes in your usage patterns.

Work Wardrobe and Upkeep

Some of us enjoy getting ready and going in to work. Maintaining a professional appearance at work can require a significant investment in clothing and grooming products.

Assessing your current wardrobe, researching costs, setting a monthly budget, and looking for ways to save can all help you stay within your budget while still maintaining a professional appearance at work.

There you have it, 17 things to include in your budget. Creating a budget helps you track your income and expenses, identify areas where you can save money, and prioritize your spending to ensure you are living within your means, and it doesn’t have to be scary. There are so many tools available to help achieve your financial goals!

If I can do it, so can you!