Attaining financial freedom is an objective for most individuals. It means you have enough savings, investments, cash on hand to support the kind of lifestyle you desire and ultimately makes you feel good about your financial situation.

One of the best ways to achieve financial freedom is through budgeting. Without a clear action plan for how you spend and save your money, you lack the ability to plan appropriately for life’s known and unknown events.

Photo by micheile dot com on Unsplash

These 10 simple ways to create a budget will help you create a budget that you can actually stick to, without feeling overwhelmed and overly restrictive:

1. DETERMINE YOUR TIMELINE

The first step to building a real budget is to define if you want to calculate it weekly, fortnightly or monthly. One way to define the periodicity of the budget is by identifying how often you receive economic income, i.e. you get paid weekly.

2. IDENTIFY YOUR FIXED AND VARIABLE INCOME

When creating a budget spreadsheet or tracking system, you want to look at your different kinds of income. I’d suggest having one column that’s separate your fixed income; that is, those that they receive periodically. Salary or a monthly retainer fee are examples of your fixed income.

In another column, add your variable income. This is additional or inconsistent income, such as payment for overtime or side hustles. Freelancers who don’t receive set income may also choose to put their payments in this column.

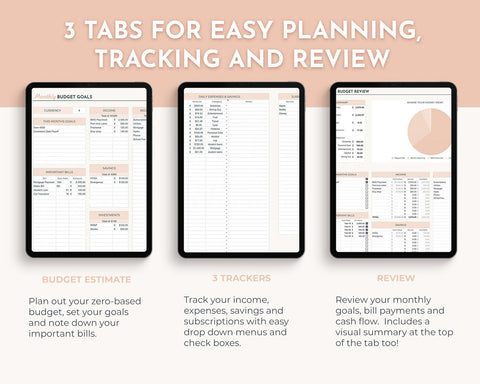

Have a look at this easy and simple budgeting tool:

3. DETERMINE YOUR FIXED AND VARIABLE EXPENSES

Fixed expenses are mandatory expenses that you pay the same amount from month to month, such as rent, mortgage, credit card payment, etc.

Variable expenses are the type that change from month to month, such as groceries, entertainment, eating out, gifts, etc. If you aren’t sure of these estimates, take a look at your bank statements over the previous months.

4. CATEGORIZE YOUR EXPENSES

It is important that when you detail your expenses in the tracker, you separate them into general categories. This will help you better see where you’re spending your money, the maximum budget you want to give to each category, and track how you do within the budget each month.

Some general categories are debts, household expenses (rent, utilities), savings/investments, and living expenses. Your living expenses may be broken into smaller categories, such as food, personal care, transportation, vacations, and your cell phone plan.

5. ALLOCATE A LIMIT AMOUNT

Distribute your income based on the expenses you have, setting a maximum amount for each category. Start with your fixed expenses, then distribute the remaining income throughout the other categories based on your typical spending and priorities.

Setting a monthly limit within each category will help you not to exceed your budget and better control your expenses.

6. ESTABLISH AN AMOUNT FOR MISCELLANEOUS EXPENSES

We know that one-off expenses like those unexpected car repairs, a spendy night out with your friends, or school trip for your kiddos. Therefore, we recommend that you assign a limited amount for “miscellaneous expenses” in order for you to meet your budget and spend wisely.

7. MONITOR YOUR BUDGET

Circumstances change. Your income and expenses are likely to change and fluctuate throughout the year. You may also change your priorities and what spending is the most important to you. That's why you should periodically review your budget, to adjust it to your current financial situation.

8. CONSIDER HAVING AN EMERGENCY FUND

This way you can ensure that, in the event of an unforeseen economic event, you have the necessary resources to deal with a contingency. You can place a percentage of your paycheck into this emergency fund every time you’re paid.

9. SAVE YOUR LEFTOVER MONEY

If you didn't spend all the money listed in your budget income, we suggest you save that amount for future investments or projects. But don’t put your money under the mattress! Remember that you can open a savings account online, in just 10 minutes.

10. SET FINANCIAL GOALS

Now you know that having a structured budget will help you save more. Use that extra money to organize family vacations, improve your quality of life or fulfill any personal goal. Follow these tips to start planning your savings!

That first step of creating your budget can seem like a hassle. But while it takes a bit of time and energy, it's worth the extra effort. A thorough personal budget gives you the financial information you need to make the right decisions for your finances to grow, expand and prosper in the future.

If building a budget spreadsheet or tracker sounds complicated to you - don’t worry! I have you covered with our Budget Tracking spreadsheets that will automatically calculate your earning and spending, making budgeting a breeze. Check out our line of digital budget trackers here.