Have you ever been behind so many bills that making a budget becomes challenging?

Budgeting can be a great way to get ahead and stretch your income further. But budgeting may not be the first thing on your mind when you're already behind on bills.

You may even feel like you've shot all your financial resources at being able to pay the monthly bills that are due. However, saving money and living within your means is still possible using the right budgeting strategies.

6 Steps to Budget When You are Behind on Bills

Bills can take a toll on your nerves and wallet. Here are some steps you can take on how to budget when you are behind bills and start paying them on time.

Step #1: Evaluate Your Financial Status.

When dealing with debt problems, it's easy to get caught up in the stress of not knowing how much money is coming in or going out. To avoid this confusion, it's important to keep track of all of your income and expenses. If you don't know where your money goes each month, creating a budget that works will be challenging.

You have to do these two essential things:

- Categorize your expenses

The first thing you should do is write down your monthly income. This number represents the total amount of money that will be deposited into your checking account at the end of each month if there are no other sources for those funds (such as bonuses or reimbursements).

Next, make a list of every single thing you spend money on each month. Include big expenses (such as rent), small ones (like candy bars), and everything in between.

In addition to listing your expenses, make sure you list all your monthly debt payments on this list. The best way to do that is by looking at the last two months' bank statements. This will give you a good idea of where your money has been going lately—and whether or not there's enough left over for something new!

To help you organize your expenses, please download my monthly budget worksheet. This will assist you in organizing the process and setting up a simple budget for yourself.

Add up all your monthly expenses and subtract that amount from your total income. (My worksheet automatically shows the total amount from your monthly income.)

- Catch up on bills that are past due.

If you are behind on bills and cannot afford to save money, don't worry about it. Create a separate budget category and make it the highest priority—for now.

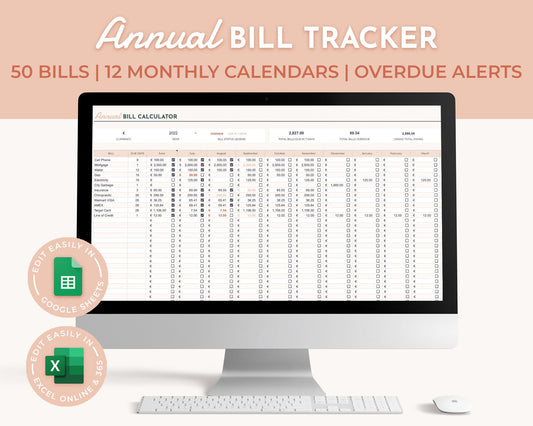

This Bill Tracker will help you make consistent monthly payments (good for your credit score). It has a smart calendar to remind you of due dates and allows savings assessment.

Step #2. Be sure to research all of your options.

If you're behind on bills, the good news is that there are options. The bad news? There are so many options that it can be confusing to figure out which is best for your situation.

Photo by Chanhee Lee on Unsplash

Here's what to consider when choosing a debt relief solution:

If you're behind on a bill, you should contact the company or agency that issued it. Most companies have payment plans for their customers who fall behind, and some even offer discounts for those who pay on time.

- Credit cards may offer lower interest rates or payment arrangements if you call in advance.

- Utility companies may offer reduced rates or payment plans if they think they will lose customers if they don't help them out.

- Banks may reduce late fees if they believe the customer needs financial help getting back on track.

- Landlords may let tenants with good credit histories slide on late rent payments so long as they agree to pay their rent on time.

Step #3. Become aware of the problem areas.

Now that you've created a budget, it's easy to review your spending habits and see whether or not they align with the budget. There are likely categories in your budget that you can reduce.

Are you spending too much on groceries? What about your coffee addiction?

Photo by Boxed Water Is Better on Unsplash

It's essential to keep your problem spots in mind as you work on your budget. If you are behind on your bills, it might be time to cut out the small luxuries until you catch up.

Step #4. Cut your spending.

Paying off past-due bills will require extra funds. You may have to pay more than your minimum payment for a while to catch up and meet other financial obligations. To address this issue, you can: reduce your expenses or increase your income.

To reduce spending, you should address the problem areas identified in Step #3. In addition to lowering your Fixed Expenses, you should also look for ways to cut down on variable expenses—those that are not absolutely essential.

Here are some ways to lower your expenses:

- Cell Phone Plan

- Entertainment Expenses

- Fuel

- Shopping

- Eating out

Step #5. Look for an extra income.

The next step is to start making extra income.

Now is the time to look for opportunities that could lead you to make some extra money. You can make extra money by doing several things. Learning to be resourceful can help you earn extra income, and here are some ways to do so:

- Sell some stuff that's not needed or necessary - If you have things taking up space in your house — like clothes or furniture — consider selling them on sites like Craigslist or eBay.

- Turn a hobby into cash - If you have any hobbies that could potentially turn into a business, give it a shot.

- Look for freelancing opportunities - Freelancing is another great way to earn extra income when you're behind on bills. You'll need skills like writing and design. This option may be worth checking out if nothing else seems feasible right now!

- Passive Income - Passive income is money you earn while you are sleeping, on vacation, or even when you're not at work. You can find passive income sources in the form of a side hustle, a monthly subscription, an app or eBook that sells well, or even by investing in companies that pay dividends.

Photo by Gabriel Benois on Unsplash

Step #6. Update your budget frequently.

It's essential to update your budget frequently. If you wait until the end of the month, you'll probably be shocked by how much you've spent on groceries or gas. Try tracking your spending at least once a week so that you can adjust accordingly if needed.

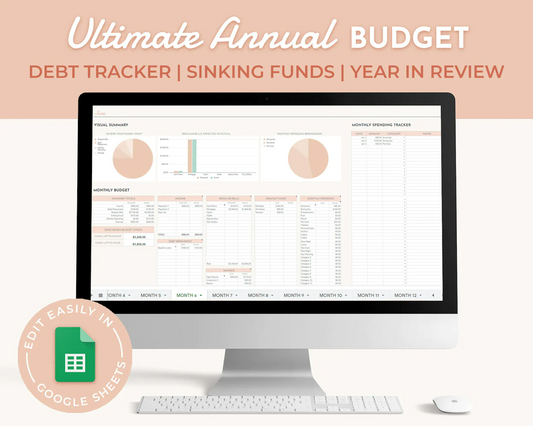

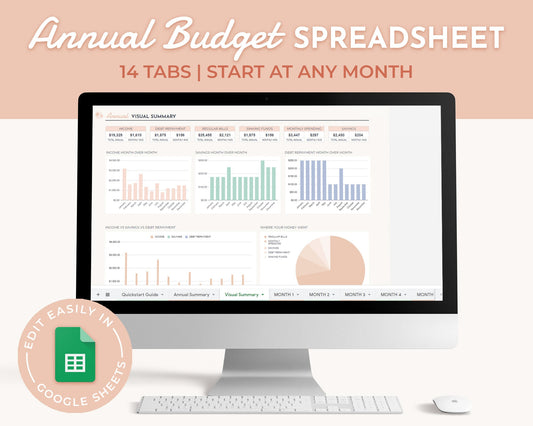

You can use a spreadsheet to create your budget like these.

But it doesn't matter what tool you use as long as it's easy for you to use and understand.

It's never too late to start budgeting. It doesn't matter if you fell behind a little bit or a lot--the most important thing is to get back on track and start saving once more. Take stock of your particular situation, create a realistic budget, and follow it!

Needed a budgeting tool to kick-start your monthly budgets? Find everything you need here.