For years I tried every savings trick in the book: automatic transfers, color-coded apps, even guilt-fueled no-spend challenges.

But the truth? None of it stuck.

Every month started with the same good intentions…and ended with a swipe of the debit card and a whispered “next month will be better.”

If that sounds familiar...you’re not broken. You just need a realistic system that feels human, not high-pressure.

This post isn’t about cutting more or hustling harder. It’s about the simple spreadsheet that helped me finally save consistently.

1. I Needed a System That Felt Like Me (Not a Math Test)

The first time I opened a “popular” budgeting template, I wanted to cry.

It was all formulas and boxes. No soul, no sense of life. I wanted something that felt like a conversation, not a calculator.

So I made one.

I opened Google Sheets on a quiet Sunday morning. Coffee in hand, cozy sweater, sun spilling over my desk and created three simple tabs:

-

Monthly Overview: income + fixed expenses

-

Savings Goals: visual progress bar

-

Reflection Space: what worked, what didn’t

It wasn’t perfect. But it was mine. And that mattered more than any budgeting rulebook ever had.

2. I Stopped Trying to Save “Perfectly”

Before, I’d aim for huge, unrealistic savings targets like $1,000 a month on an average income. It always ended the same way: burnout and disappointment.

The spreadsheet helped me slow down. It showed me that saving $50–$100 consistently was better than saving $500 once.

So I built in a flexible goal column. Something I could shift each month depending on what life looked like.

Some months, it was $40. Other months, $400.

That permission to adapt made me stick with it.

Mini story: The month I saved just $25, I celebrated it with a walk, not a purchase. That tiny win changed everything. I felt proud, not pressured.

3. I Made Progress Visible (Because Motivation Needs Proof)

Here’s what no one tells you: motivation fades fast when your goals stay invisible.

That’s why the third tab, the visual tracker, was my secret weapon.

I added a simple formula that filled a soft green progress bar as I saved. Watching that bar inch forward each week was ridiculously satisfying.

When I saw my first full bar, $500 saved, I didn’t just feel “responsible.” I felt safe.

“Progress doesn’t need to be loud to be powerful.”

If you’re a visual thinker, this step changes everything. Numbers become stories. Stories become habits.

4. I Tied Every Goal to a Feeling, Not Just a Number

Instead of naming my goals “Emergency Fund” or “Car Repair,” I renamed them things like:

-

Peace of Mind Fund

-

Slow Morning Savings

-

Future Freedom Jar

It made the spreadsheet emotional, not in a bad way, but in a grounding way.

Every time I transferred money, I wasn’t just saving. I was nurturing a version of myself that valued calm over chaos.

That emotional tie kept me connected. Because money is emotional it deserves to be treated that way.

5. I Made Reflection a Monthly Ritual

At the end of each month I light a candle, play soft music, and spend 15 minutes with my spreadsheet.

I write down three things:

-

What I did well

-

What felt hard

-

One realistic tweak for next month

That small ritual makes my finances feel calm, almost meditative.

It’s not about perfection. It’s about awareness and self-kindness.

And that’s what keeps me consistent.

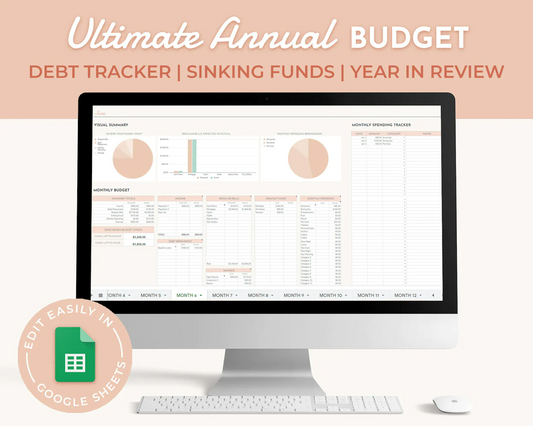

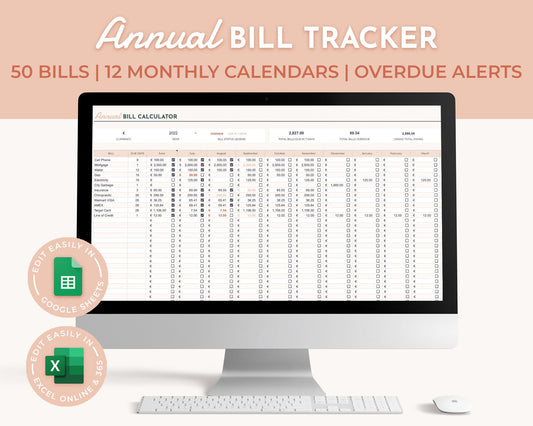

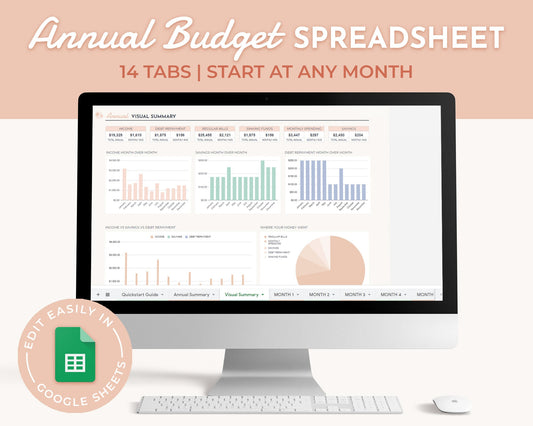

If you’re ready for a practical way to track your money, the Confident Coin Savings Goals Tracker includes these same features: visual bars, reflection prompts, and soft neutral colors to keep you grounded. It’s the exact system I use (and refined) over time.

Explore the Tracker Here: