Find out how to stop spending and start saving $1000 with this $1,000 Saving Challenge for 3 Months!

Spending money on unnecessary things is like throwing away money, but let's admit it's not that easy!

You probably make a lot of purchases without thinking about whether you really need them, but those small decisions add up over time.

Are you aware of your spending habits?

We know it's a difficult question. Because when we think about how much money we're spending, we can't help but feel like we're being robbed.

But what if there was a way to save some of that money and get more bang for your buck?

Well, here's the thing: there is! And it's easy (and fun!) to do.

$1,000 Saving Challenge for 3 Months!

It's time to finally take control of your finances and start saving money this year!

Setting up a challenge and having a goal in mind will help you save for your dream holiday, a big purchase, or to pay off debt.

Without a goal, it's easy to lose sight of what you're trying to achieve. And without motivation, saving money is nearly impossible.

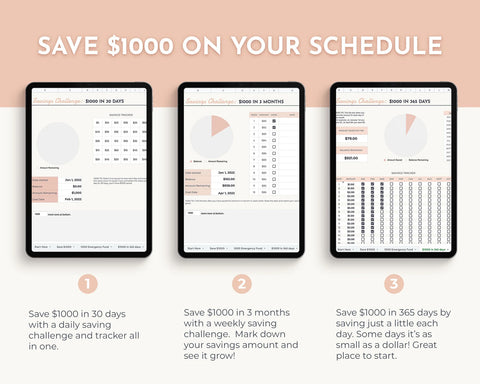

Thus, I created an easy-to-use spreadsheet to help you with saving: the $1,000 Saving Challenge for 3 Months!

Get our super easy-to-use, automated $1,000 Saving Challenge spreadsheet here!

This 3-month savings challenge is a great way to save $1,000. You can start as soon as this week!

By following these steps, you will have an extra $1,000 in your savings account.

To help you with your saving challenge, I've put together a list of things you can cut off to save money. This is sure to get your savings back on track!

Save $1000 in 3 Months Challenge: 7 Things to Do

1. Eat at home more often

Save: Up to $100/month

You can save money by cooking your meals instead of eating out. If you want to cut back on spending on food, here are some tips:

- Eat leftovers for lunch the next day (or freeze them), and

- Cook double portions when you make dinner so you have extra leftovers.

- Try new recipes from scratch (i.e., not from a box or pre-made meal kit), which can be healthier than processed foods and save money compared to eating out.

Plan out your meals ahead of time by writing down what you plan to eat each week and making a shopping list based on those meals (so you don't buy extras). It takes less time to cook your meal than waiting in line at a restaurant or drive-through!

2. Stop buying coffee every day

Save: Up to $120/month

If you buy just one cup of coffee daily at your local coffee shop, that can add up to over $120 per month! Instead, bring your coffee home and bring it with you or buy a reusable mug that will get you discounts on refills at many restaurants and cafes. You could also invest in a Keurig machine if you like having different flavors of coffee without having to buy the K-Cups!

Photo by Angelica Reyes on Unsplash

3. Cut the cord on cable

Save: Up to $100/month

Cutting the cord is a great way to save money on your monthly expenses. You no longer have to pay for cable TV, Internet, or phone service if you don't use it all that much (or cancel entirely).

It's easy to justify a monthly subscription when you have nothing better to do on weekends than binge-watch Netflix, but what happens when your favorite show is over? You still have a cable bill. You don't need cable TV to be entertained; there are plenty of free options available online (or even through your library), such as Hulu and YouTube. You can save $100 a month or more by cutting the cord.

Photo by Alexander Mils on Unsplash

4. Stop shopping so much — especially online!

Save: Up to $50/month

Retail therapy may make you feel better temporarily, but it's an expensive habit that will leave you broke in the end. If you're looking for a great deal, check out eBay or Craigslist for gently used items at a fraction of the cost of new ones.

If you have a problem with impulse buying, make your finances more manageable by creating and sticking to a budget that leads us to.

5. Track your expenses and create a budget

You need to know where your money is going before making changes to improve your spending habits. Unless you have already handled your finances, this may be the hardest step of all — but it's also the most important one.

Once you've figured out where your money is going, create a realistic budget based on your income and expenses. This will help ensure you have enough money left over for savings after covering your essentials (rent/mortgage, utilities, food, etc.).

Here's a simple spreadsheet tool to help you create and stick with a budget! It comes in weekly, monthly, or annual versions—whatever works for your paycheck.

6. Declutter Your Wardrobe

Earn up to $100

The first thing to do is declutter your wardrobe. Take everything out of your closet and put it on the bed or floor. Then go through everything piece by piece, trying it on if possible (or at least thinking about how it looks). Donate it or sell it online if something doesn't fit or isn't flattering. You may find that there are some items that you do want to keep after all but only one or two!

7. "Brown bag" your lunches

Save: Up to $180/month

Bring food from home instead of buying it at the cafeteria or deli down the street from work. Pack a healthy lunch and save money at the same time!

Brown bagging is a great way to save money on food because it allows you to make healthy choices by packing more vegetables, fruits, and leftovers than you would have if you were buying lunch at a restaurant or fast-food place.

So, what kind of things can you do with this list?

It's essential to recognize that you can still live well if you spend less. You don't need to change your lifestyle drastically.

Keep me posted on how your challenge is going!

Good luck!