Are you looking for a way to pay off debt, save more money, and keep your budget in check? The cash envelope system is one of the easiest ways to manage your money.

The cash envelope system is a tried-and-true money management technique that can help you get a handle on your finances. In this guide, we'll show you how it works and why it's so effective—plus, we'll give you some tips on how to make the most of it.

What is the cash envelope system?

It's a budgeting method that involves separating your income into different envelopes, so it's easier to track where your money is going. Each envelope has a predetermined amount of cash—usually enough for one or two weeks of expenses—and once that amount is gone, it's gone. You can't spend any more money on that envelope until next week.

How does it work?

The cash envelope system helps you keep track of your personal spending by using envelopes that are labeled with categories like "Food," "Clothing," and "Entertainment."

Each week, you put money from your paycheck into each envelope, keeping track of what's left in each category throughout the month.

Why does it work?

The cash envelope system is an effective way to budget because it forces you to see exactly where your money is going each month. When you have physical bills in front of you daily, it's easy to forget them and spend more than necessary. But when those bills are inside an envelope with a specific purpose, like food or entertainment, they stay in your mind and remind you what your budget is.

Photo by Alexander Grey on Unsplash

How to use the cash envelope system?

Step 1: Create your budget.

Use pen and paper (or a spreadsheet) to list all of the monthly expenses you'll have, including rent or mortgage payments, groceries, utilities, car payments, student loans, etc., and how much you think each one will cost every month.

Step 2: Look at the categories of your spending.

Next, look at your budget and divide it into categories based on what type of spending each expense falls under (e.g., groceries vs. bills vs. entertainment). Also, consider whether one category might be more important than another when deciding where to spend money this week or month!

Each week or month when you get paid, divide up your paycheck into these categories:

- Groceries

- Entertainment

- Bills/Insurance/Utilities/Rent

- Misc.

- Clothing

- Pets

- Gifts

- Car

- Health

- Emergency

Step 3: Set limits for each category

Before you start filling your envelopes with cash, decide how much money you want to spend on different categories, such as groceries or entertainment. You may also want to set aside money for an emergency fund or other savings goals.

Step 4: Fill your envelopes with cash

Now comes the fun part! Fill each envelope with the cash amount it corresponds with. Then set them aside until payday rolls around!

Step 5: Adjust as needed

Adjust your envelopes accordingly if you're overspending in one area or not saving enough in another. You might even want to set up separate envelopes for different types of spending (e.g., one for bills and another for clothes).

Where to find your cash envelopes?

Plain envelopes

This is the easiest way to have your cash envelope. You can purchase plain envelopes at any stationery store.

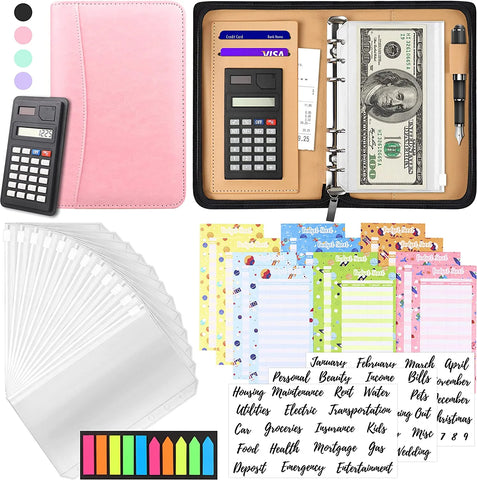

Amazon

Amazon has a wide range of products you can use for your cash envelope system. These products include:

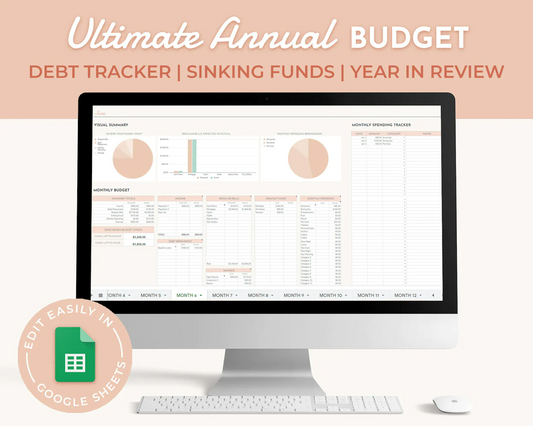

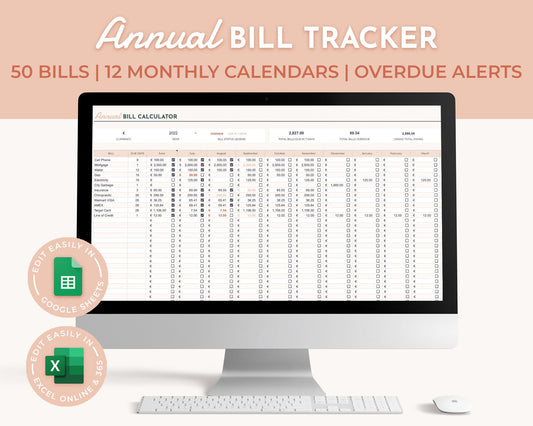

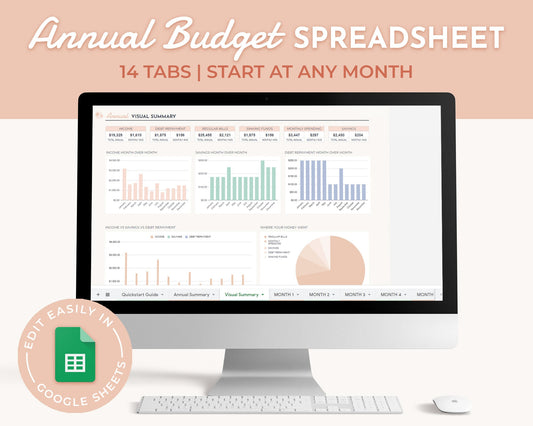

Digital Cash Envelope

You can also try this digital cash envelope tracker spreadsheet. It's free, and you can use it on your phone, tablet, or computer. You just enter the amount you need each week, and it will track how much money is left.

The cash envelope system is one of those time-tested money management strategies that almost anyone can use and start seeing results. It's one of the best ways to get your finances under control, and it's not nearly as complicated as you might think. Give it a shot, even if you're hard-pressed for time. Keep your eyes on your cash, and keep digging out of debt!

Good luck!