Have you ever wondered how to budget your money more efficiently?

If you're like most people, the answer is probably a resounding "yes."

Most of us are tired of living paycheck-to-paycheck and would love to have some extra cash in our pockets at the end of each month.

But what if there was a way to make that happen? What if you could pay off debt faster? Or start saving for retirement? Or take that dream vacation to Hawaii for Thanksgiving this year?

It turns out there is! And all it takes is following the 50/30/20 rule. It's so simple, and it just might change your life.

The 50/30/20 rule is a straightforward budgeting formula you can use to help manage your finances more efficiently.

What Is The 50/30/20 Rule?

The 50/30/20 rule is a popular budgeting strategy that anyone can use regardless of income. It divides your income into three categories: "needs," "wants," and "savings."

Is the 50/30/20 Budget Right for You?

If you've tried to budget before, but it never quite stuck, a 50/30/20 budget might be helpful for you.

With the 50/30/20 system, you can start with simple financial goals and get more complex as your personal finance knowledge grows.

How to budget your money with the 50/30/20 rule

It's common advice: budgeting your money is an excellent way to ensure you're spending it wisely.

But how do you budget? If you're like most people, it feels like a daunting task. You could use all kinds of fancy tools to help, but what if you just want something simple? Something that will work for you right now?

Step 1. Spend 50% of your money on needs

Needs are expenses you cannot live without and are the top priority when making spending decisions. The 50% you spend on these items should be spent wisely.

This includes rent or mortgage payments, utilities, groceries, and transportation costs.

Relevant: Budget by Paycheck Google Sheet (Pink) - For Beginners

Step 2. Spend 30% of your money on wants

Wants are items or experiences you would like to have but do not need to survive or be happy. The 30% you spend on these items can be spent however you want, but the key is to not go over budget!

This includes restaurants, phone upgrades, entertainment, personal care, and gym memberships.

Step 3. Stash 20% of your money to save

This is what will help you reach financial freedom in the long run. Savings should be stashed away for future goals, such as an emergency fund or retirement account — these funds should not be touched unless an emergency arises. Your savings should be kept separate from checking accounts, so they don't feel like part of your monthly budget; instead, they should go into separate accounts where they can grow over time without being spent frivolously.

This is best for emergency funds, debt repayment, retirement.

How to apply the 50/30/20 rule: a step-by-step guide

Here are the steps to creating and implementing a 50/30/20 budget spreadsheet.

Step 1: Figure out your take-home pay.

The first step is figuring out how much money you make each month. This might require some math or checking your paycheck stubs or bank statements, but knowing how much money you're bringing in is essential before making any changes to your spending habits.

For example, if you get paid $1,500 per month but have $300 deducted for taxes and another $120 deducted for health insurance premiums, then your net pay would be $1,240 per month (1,500 - 300 - 120 = 1,240)

Step 2: Calculate your percentages.

Now comes the fun part: calculating what percentage of your income will go towards each category.

Once you know how much money you make each month, calculate the percentages for each category: 50% needs; 30% wants; 20% savings.

Then categorize all of your expenses into these three categories. Write down everything that fits into each category and add the totals for each category and for total spending per month (needs + wants + savings).

For this example, let's assume a take-home amount of $2,000 per month.

Needs - 50% ($2,000 x 50% = $1,000)

Rent - $500

Utility - $150

Insurance - $150

Groceries - $170

Transportation - $30

Wants - 30% ($2,000 x 30% = $600)

Restaurants - $100

Personal Care (clothes, hair, makeup) - $125

Pets - $100

Entertainment (Netflix, Spotify) - $25

Travel - $250

Savings - 20% ($2,000 x 20% = $400)

Emergency fund - $200

Retirement fund - $100

Debt repayment - $100

Step 3: Adjust your spending and saving.

Once you've figured out how much money you should spend on each category, it's time to adjust your budget to align with what the 50/30/20 formula recommends.

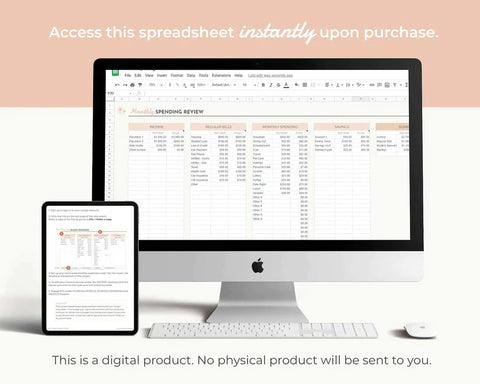

If you're unsure whether this will work for your budget, try using our easy-to-use budgeting tool to see where your money goes now and how much extra income would be needed to make changes in each category.

All you need is just enter and fill in the amounts necessary to start up your 50/30/20 budget.

The 50/30/20 budget is a great budgeting model for beginners because it frees them from worrying about creating categories.

It's an easy system to understand and follow, and with just a few modifications, you can use it forever.

It's flexible enough that this budget will be a good fit no matter how your income fluctuates over the years.

Give it a try, and it just might work for you.

Does the 50/30/20 budget seem reasonable to you?

Would this change in any way if you could set aside $1,000 for fun each month too? Leave a comment below and share your thoughts!